What the Panama Papers Mean for Global Development

SPOTLIGHT, CAPITALISM, WHISTLEBLOWING - SURVEILLANCE, 25 Apr 2016

Tharanga Yakupitiyage – Inter Pres Service-IPS

12 Apr 2016 – The financial secrecy and tax evasion revealed by the Panama Papers has an extraordinary human cost in developing countries and threatens the realisation of the UN’s ambitious Sustainable Development Goals.

The ongoing leak — made public by media outlets including German newspaper Süddeutsche Zeitung, the International Consortium of Investigative Journalists (ICIJ) – has already prompted protests and investigations around the world. The papers connect thousands of prominent figures to secretive offshore companies in 21 tax havens and reveal the inner workings of the offshore finance industry.

The documents focus on Panamanian law firm Mossack Fonseca, with its 210,000 entities, and has led to allegations that the firm aided public officials and multinational corporations to avoid taxes. Mossack Fonseca say that media reports have misrepresented the nature of their work and its role in global financial markets.

In one case, leaked emails contained in the Panama Papers suggest that the Heritage Oil and Gas Ltd Company (HOGL), sought help from Mossack Fonseca to sidestep tax laws in Uganda. According to ICIJ, upon the sale of an oil field, the company received a tax bill of $404 million. In an effort to avoid paying the taxes, the entity fought the Ugandan courts and meanwhile tried to relocate to Mauritius, according to the leaked emails.

Mauritius has a double tax agreement with Uganda, allowing companies such as HOGL to only pay taxes in one of the two countries. In 2000, the International Monetary Fund (IMF) listed Mauritius as a preferred location for companies due to its minimal tax laws.

These havens deny developing countries such as Uganda of much needed tax revenue for essential services, Oxfam’s Senior Tax Policy Advisor Tatu Ilunga told IPS.

“Tax havens are at the heart of a global system that allows large corporations and wealthy individuals to avoid paying their fair share, depriving governments – rich and poor – of the resources they need to provide vital public services and tackle rising inequality,” said Ilunga.

In Uganda, approximately 37 percent live on less than $1.25 per day. The East African nation also has one of the highest rates of maternal and under-five mortality rates in the world. According to the World Health Organisation (WHO), Uganda is one of the top ten countries that account for the majority of global maternal deaths.

In a country that lacks access to health services, HOGL’s $404 million in taxes represents more than the country’s health budget.

Former governor of Nigeria’s oil-rich Delta State James Ibori was also implicated in the Panama Papers,allegedly using Mossack Fonseca as an agent for four offshore companies in Panama and Seychelles. These entities provide anonymity, hiding true owners’ names and actions and thus allowing for finances and assets to be undeclared and untaxed.

Though he was detained in 2012 for diverting up to $75 million out of the country, Nigerian authorities estimate that Ibori stole and stored over $290 million in tax havens.

Like Uganda, Nigeria ranks low in health indicators, contributing to some 10 percent of global maternal, infant and child deaths. Poverty has increased in the country with 61 percent living below the poverty line, according to the most recent Nigerian Bureau of Statistics report.

The Niger Delta region in particular, despite being a significant contributor to the country’s economy through oil production, remains the poorest and least developed region in Nigeria. In Ibori’s Delta state alone, 45 percent of people live in poverty. The UN Development Programme (UNDP) report found that the majority of people in the region lack access to potable water, electricity, health facilities and infrastructure including roads and telecommunications.

“Have you seen any taps here?…Water used to run in public taps, but that had stopped 20 years ago. We basically drink from the river and creeks…hygiene is secondary,” a Niger Delta Resident told UNDP.

Though Ibori’s stashed money represents only a slice of Nigeria’s budget, it is indicative of a global and pervasive problem that goes beyond Mossack Fonseca.

Transparency International’s Senior Policy Coordinator Craig Fagan told IPS: “If you think about the millions of files that have been released and the number of high profile individuals [in the Panama Papers], this is just one law firm in Panama.” .

“We can be certain that there are many other law firms whether in London, Hong Kong, New York, Miami that are operating similar structures,” he said.

According to Oxfam estimates, at least $18.5 trillion is hidden in tax havens worldwide. The organisation found that two thirds of this offshore wealth is hidden in European Union related tax havens while a third is in UK-linked sites where it is left undeclared and untaxed. Oxfam said that their estimate is a conservative one.

The Swiss Leaks, also released by ICIJ in 2015, revealed how over 106,000 clients from Venezuela to Sri Lanka hid more than $100 billion in Swiss HSBC bank accounts.

Another analysis from Tax Justice Network (TJN) reveals that between $21 to $32 trillion is being diverted into offshore companies.

This has enormous effects in developing countries, costing poor nations over $100 billion in lost tax revenues every year, according to Oxfam. The charity also found that tax dodging by multinational corporations alone costs the developing world between $100 billion and $160 billion per year. Added with profit shifting, approximately $250 billion and $300 billion is lost.

This “missing” money could lift every person above the $1.25 per day poverty threshold three times over, according to Brookings Institution calculations.

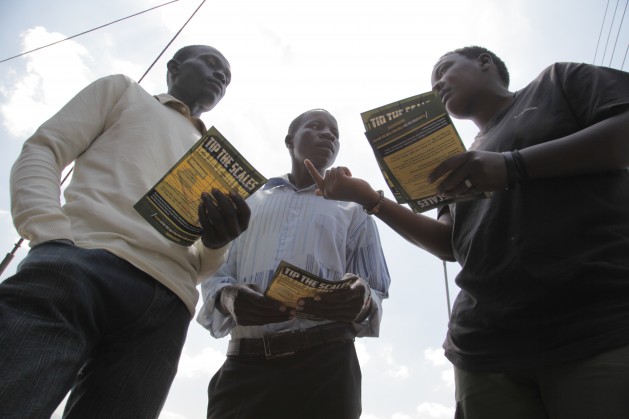

Oxfam added that for every $1 billion lost through commercial tax evasion, 11 million people at risk across the Sahel region could have enough to eat, 400,000 midwives could be paid in Sub-Saharan Africa which has the highest maternal mortality rates, and 200 million insecticide-treated mosquito nets could be purchased to reduce child mortality from malaria.

In addition to lost development finance, Ilunga also noted to IPS that such actions have exacerbated inequality in the world, stating: “This is the same rigged system that has created the situation where…the wealth of the richest 1% surpasses the combined wealth of the rest of the world.”

Though the use offshore companies is not illegal, Ilunga asserted that the legality of such actions is precisely the issue.

“Tax dodging exists in a legal gray area with some activities clearly violating the spirit of the law even though those activities are not technically illegal. But the fact that these activities are legal is precisely the scandal we are most concerned with,” Ilunga said.

Fagan told IPS that it does not matter whether it is legally acceptable to have tax avoidance schemes.

“Just because it’s not illegal does not mean it is not a form of manipulation, form of corruption,” he said.

Ilunga and Fagan noted that the Panama Papers are a wake-up call and urged governments to end harmful tax practices and close loopholes. They highlighted the need to institute a public registry which lists companies’ true owners, where money is being earned and how much is being earned.

Ahead of the United Kingdom’s anti-corruption summit to be held in May 2016, Oxfam and TJN also called on the U.K. to lead the fight by halting their large network of tax havens including in the British Virgin Islands and the Cayman Islands.

“The anti-corruption summit provides an opportunity to dismantle the financial secrecy that threatens the [Sustainable Development Goals’] progress against poverty before it even begins,” said Oxfam Policy Advisor Luke Gibson and TJN’s Director of Research Alex Cobham in a briefing paper.

Cobham told IPS that though global reforms are essential, domestic stakeholders must ensure that tax revenues will be used to help meet the recently adopted Sustainable Development Goals (SDGs).

Included in the SDGs are commitments to reduce illicit financial flows and corruption by 2030 and to strengthen domestic resource mobilization including improving capacity for tax and revenue collection.

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.

Read more

Click here to go to the current weekly digest or pick another article:

SPOTLIGHT:

- The Prevention of Literature

- How Trump Can Turn Back the Doomsday Clock

- Brazil-USA: A Tale of Two Caudillos

CAPITALISM:

- January 20, 2025

- The Dismal Pseudo-Science

- Trillions in Dirty Money: How Hidden Loopholes Fuel Corruption and Inequality

WHISTLEBLOWING - SURVEILLANCE: