The World’s Largest CBDC Trial: A Preview of the Elite’s Cashless Vision for You

CAPITALISM, 27 Mar 2023

Nick Giambruno | International Man - TRANSCEND Media Service

23 Mar 2023 – The eNaira is Africa’s first central bank digital currency (CBDC).

Central bankers, academics, politicians, and an assortment of elites from over 100 countries hoping to launch their own CBDCs have closely followed the eNaira.

They used Nigeria—Africa’s largest country by population and size of its economy—as a trial balloon to test their nefarious plans to eliminate cash in North America, Europe, and beyond.

Are you concerned about CBDCs?

Then you should be paying attention to what is happening in Nigeria.

That’s because there’s an excellent chance your government will reach for the same playbook when they decide to impose CBDCs in your area—which could be soon.

CBDCs enable all sorts of horrible, totalitarian things.

They allow governments to track and control every penny you earn, save, and spend. They are a powerful tool for politicians to confiscate and redistribute wealth as they see fit.

CBDCs will also enable devious social engineering by allowing governments to punish and reward people in ways they previously couldn’t.

CBDCs are, without a doubt, an instrument of enslavement. They represent a quantum leap backward in human freedom.

Unfortunately, they’re coming soon…

Governments will probably mandate CBDCs as the “solution” when the next real or contrived crisis hits—which is likely not far off.

That’s why you must pay attention to what is happening in Nigeria. That way, you can know what to expect and take preventative action.

Here are the top five insights from the eNaira.

Insight #1: Don’t Take the Bait… Reject CBDC Incentives

In Nigeria, the government implemented discounts and other incentives to increase the adoption of eNaira.

In North America and Europe, expect the government to require CBDCs to receive welfare payments, a potential universal basic income, so-called “inflation relief checks,” or whatever the next cockamamie scheme is.

Think of these incentives like the cheese in a mousetrap.

Insight #2: Simultaneous Moves To Eliminate Cash

To help boost eNaira adoption, the Nigerian government announced a plan to remove the legal tender status of various high denomination bills, rendering them worthless.

According to the World Bank, over 55% of the adult population in Nigeria does not have a bank account and is dependent on physical cash.

The Nigerian government must have known phasing out cash would be a disaster for a majority of the population, but they plowed ahead anyways—so much for democracy.

When your government imposes a CBDC, expect simultaneous measures to force people out of cash, regardless of the costs.

Those measures could come in many flavors, but I would bet they would first look to phase out large denomination bills by removing their legal tender status.

We’re already seeing this happen…

For example, the EU has already phased out the 500 euro note.

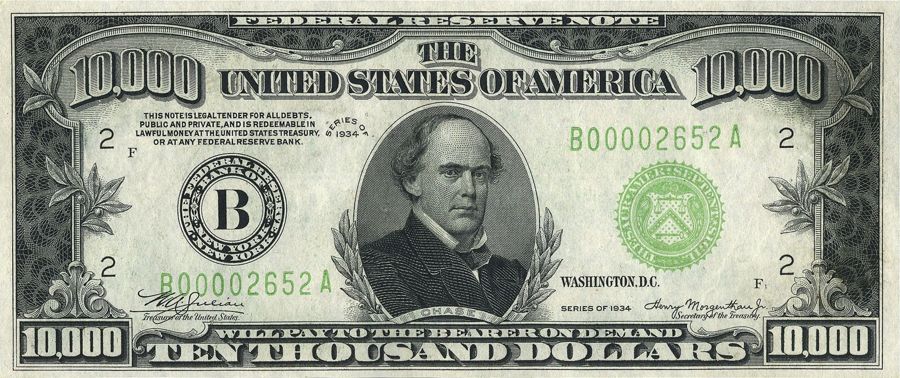

The $100 bill is the largest in circulation in the US, but that wasn’t always the case. At one point, the US had $500, $1,000, $5,000, and even $10,000 bills.

The government eliminated these large bills in 1969 under the pretext of fighting the War on (Some) Drugs.

The $100 bill has been the largest ever since. But it has far less purchasing power than it did in 1969. Decades of rampant money printing have debased the dollar. Today, a $100 note buys less than $12 in 1969.

Even though the Federal Reserve has devalued the dollar by over 88% since 1969, it still refuses to issue notes larger than $100.

With CBDCs on the horizon, I think the US government will not only never issue another bill higher than $100 but will probably look to phase out the $100 bill under various pretexts.

Insight #3: Bank Restrictions

Most people think of the money they deposit into the bank as a personal asset they own.

But that’s not true.

Once you deposit money at the bank, it’s no longer your property. Instead, it’s the bank’s, and they can pretty much do whatever they want with it.

What you really own is the bank’s promise to pay you back. It’s an unsecured liability, which makes you technically and legally a creditor of the bank.

And since the banking system is intertwined with the government everywhere, it’s only prudent to expect governments to place more restrictions on bank accounts as CBDCs debut.

This is exactly what happened in Nigeria.

Cash withdrawal limits and debit card transaction restrictions were imposed, among other measures. In addition, capital controls made it challenging to send money out of the country.

I wouldn’t be surprised to see the forced conversion of bank deposits into the eNaira—at an unfavorable rate.

Here’s the bottom line. Expect all sorts of restrictions—and possible confiscations—to be imposed on bank accounts when a CBDC is released.

Insight #4: Rising Inflation

Amid the eNaira rollout, Nigeria is experiencing some of the highest inflation levels in its history.

This is not surprising. CBDCs make it even easier for the government to debase the currency.

So, it’s reasonable to expect more inflation when CBDCs come to town.

Insight #5: Social Unrest

In another predictable development, frustrated Nigerians took to the streets over the government’s actions to restrict cash and bank accounts. There was a violent scramble to exchange old notes before the government deemed them worthless. Riots broke out in several locations.

There’s an excellent chance the destructive restrictions imposed alongside CBDCs could create social unrest anywhere.

Conclusion

To summarize, here are the top five insights from Nigeria’s CBDC experience.

Insight #1: Don’t Take the Bait… Reject CBDC Incentives

Insight #2: Simultaneous Moves To Eliminate Cash

Insight #3: Bank Restrictions

Insight #4: Rising Inflation

Insight #5: Social Unrest

As CBDCs come to your neighborhood, you now know what to expect.

Governments will probably mandate CBDCs as the “solution” when the next real or contrived crisis hits—which is likely not far off.

There’s an excellent chance more inflation and financial chaos is coming soon.

Are you ready for it?

That’s why I just released an urgent PDF guide, “Survive and Thrive During the Most Dangerous Economic Crisis in 100 Years.” Download this free report to discover the top 3 strategies you need to implement today to protect yourself and potentially come out ahead.

With the global economy in turmoil and the threat of a “Great Reset” looming, this guide is a must-read. Click here to download it.

_______________________________________

Nick Giambruno is a renowned speculator and international investor and specializes in identifying Big Picture geopolitical and economic trends ahead of the crowd. He writes about geopolitics, value investing in crisis markets, Bitcoin, second passports, and surviving a financial collapse. He has traveled to over 60 countries, lived in six of them and previously worked in a Dubai-based investment bank. Nick is also the Founder of The Financial Underground, which is dedicated to uncovering the truth about money and markets they don’t want you to see.

Nick Giambruno is a renowned speculator and international investor and specializes in identifying Big Picture geopolitical and economic trends ahead of the crowd. He writes about geopolitics, value investing in crisis markets, Bitcoin, second passports, and surviving a financial collapse. He has traveled to over 60 countries, lived in six of them and previously worked in a Dubai-based investment bank. Nick is also the Founder of The Financial Underground, which is dedicated to uncovering the truth about money and markets they don’t want you to see.

Tags: Africa, Banksters, Big Banks, Bitcoin, Central Bank Digital Currency CBDC, Central banks, Cryptocurrency, Economic Crisis, Economics, Finance, Human Experiment, Nigeria, Plastic Money

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.