Monsanto-Bayer “Combination” – Comments Submitted to Competition Commission of India

TRANSCEND MEMBERS, 22 Jan 2018

Prof. Vandana Shiva – TRANSCEND Media Service

Objections and Comments on proposed Bayer Monsanto Combination as provided under sub-section (3) of section 29 of the Competition Act

20 Jan 2018 – I submit my comments and objections to the proposed combination between Bayer and Monsanto. The first part is substantive objections to the Bayer application in the context of the past and potential violations of the Competition Act, 2002. The Second part is my comments on the general impacts of the Bayer Monsanto merger for farmers rights, food security and sovereignty in India and globally.

As the Bayer Application for merger stated, “The Proposed Combination is in the nature of an acquisition (under Section 5(a) of the Competition Act, 2002). As a result of the Proposed Combination, Monsanto will become a wholly owned subsidiary of Bayer.”

Under Section 29(2) of the Competition Act 2002, the Competition Commission, being of the prima facie opinion that the combination of Bayer and Monsanto is likely to have an appreciable adverse effect on competition, has directed the parties seeking a merger and combination to publish details of the combination for bringing it to the knowledge or information of the public and persons affected or likely to be affected by such combination.

The CCI must block the merger because it is an Anti Competitive Agreement violating Section 3 of the Competition Act, It must be rejected under Section 4 because it increases the potential for the abuse of dominant position which the company being acquired, Monsanto, has already engaged in – in the case of Bt cotton. Bayer must also be penalised under Section 44 and 45 of the Competition Act because it has made false statements and is guilty of omitting material relevant to the assessment of the combination. The details of such false statements and omissions have been specifically mentioned in this written objection para-wise. According to Section 44, Bayer is thus liable to a penalty

I make these comments, and raise objections to the proposed merger, as an expert and scientist, and Director of the Research Foundation for Science Technology and Ecology (RFSTE), who has carried out research on Agriculture, Seeds and Chemicals, and Intellectual Property Rights (IPRs) since 1984 — including for the United Nations University and UN Food and Agriculture Organisation. I have carried out research on Monsanto’s Bt Cotton and its impact on farmers, and on IPRs seed monopoly. I have participated in Ministerial Meetings of the WTO with a special focus on IPRs, Biopiracy, Farmers Rights, and our sovereign rights to our Biodiversity and indigenous knowledge.

I have been an expert of the UN Convention on Biodiversity, member of the expert group that drafted the Plant Variety Protection and Farmers Rights Act, and involved as an expert in drafting the National Biodiversity Act. I have worked closely with the Indian Parliament on the implementation of the Indian Patent Act. I have worked as an expert in Biosafety for the United Nations, and closely studied the impact of the seed, chemical industry on consumer rights to safety, specially Biosafety.

I am also a farmer and Managing Trustee of Navdanya, a farmers organisation dedicated to conservation of Biodiversity and seeds, and protection of Farmers Rights, seed sovereignty and farmers freedom to trade freely in farmers varieties that they have bred and evolved.

The proposed merger is unlike any other. It is a proposed combination in the vital sector of seeds and agriculture. The combination, therefore, impacts farmers, the public, and the nation. The Competition Act 2002 is aimed at “preventing practices having adverse effect on competition to promote and sustain competition in markets, to protect the interests of consumers and to ensure freedom of trade carried on by other participants in markets”. The submission is made keeping these aims in focus.

PART I

The proposed combination undermines all aspects of the Competition Act as well as other Acts which have already been systematically violated by Monsanto, which is being acquired by Bayer. Section 3, Section 4 and Section 44, have all been violated by Monsanto, and with the combination, the position of dominance will increase, and the combination will increase its violations Indian laws including the Competition Act, of Farmers Rights Act , Patent Act, Essential Commodities Act, Biosafety Act, among others.

The approval of the combination implies a dismantling of all the laws that Monsanto has been challenging and undermining since it entered India illegally. The Competition Commission will have created a lawless world in the vital area of seed and agriculture – the basis of food security. The experience of Bt Cotton illustrates the trend that will continue to unfold for farmers growing cotton and all other seeds and crops, corroding the entire regulatory framework of India.

1) The acquisition of a monopoly will still result in a monopoly : The case of Bt Cotton and Violation of Section 3

The CCI has already found prima facie evidence in the case on Monsanto’s Bt Cotton monopoly.

In reference case number 02/2015 and case number 107/2015, The CCI has already passed an interim order on 10/02/2016 – that Monsanto’s control of Bt Cotton is Prima Facie a monopoly.

The submission from Bayer, for the combination, in para 23 states “The Proposed Combination does not affect the existing upstream market structure. It merely leads to change in control from Monsanto to Bayer regarding Monsanto’s Bollard II technology.”

The Monsanto monopoly on Bt Cotton will thus become a Bayer monopoly on Bt cotton with all the related impacts of violating farmers rights , national seed and Biosafety laws, and Competition Law. The monopoly under investigation will disappear and a larger monopoly will take its place. The farmers, our food, our nation – all caught in the Monsanto-Bayer “downstream market structure” – could be held hostage by the resulting SuperMonopoly.

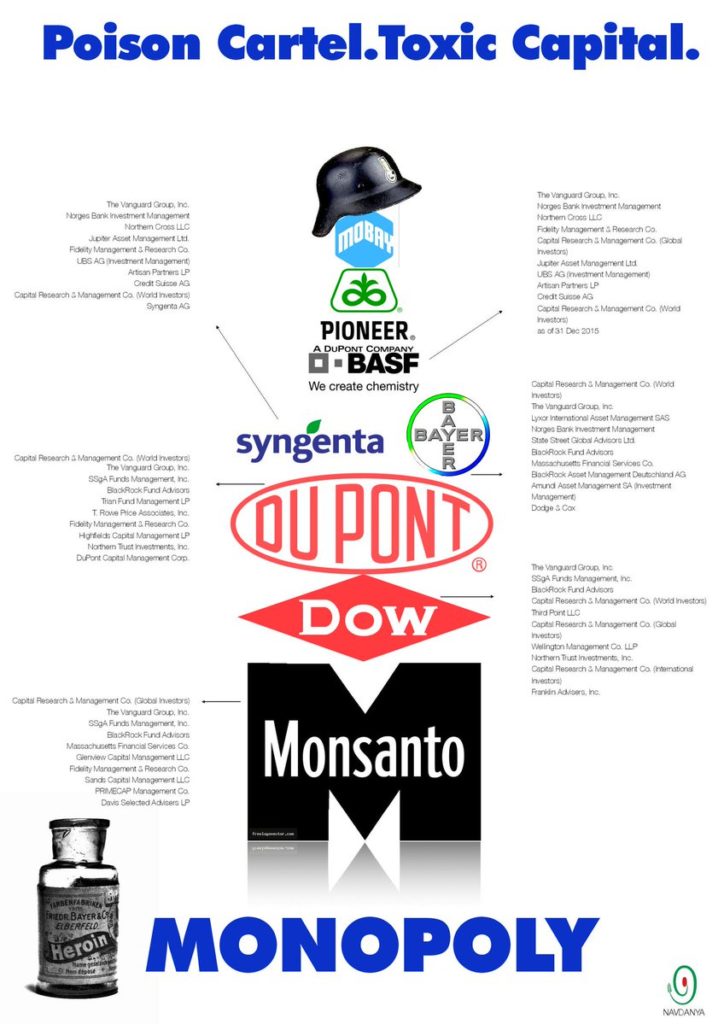

It is important to point out, at this point, that controlling stakes in both Monsanto and Bayer are already held by the same investors – which is why the “upstream market structure” remains unchanged.

| Bayer-AG | Monsanto Co. | ||||

| Name | Equities | % | Name | Equities | % |

| Capital Research & Management Co. (World Investors) | 19,308,166 | 2.33% | Capital Research & Management Co. (Global Investors) | 30,009,458 | 6.81% |

| The Vanguard Group, Inc. | 16,722,949 | 2.02% | The Vanguard Group, Inc. | 29,253,433 | 6.64% |

| Lyxor International Asset Management SAS | 15,828,584 | 1.91% | SSgA Funds Management, Inc. | 18,449,843 | 4.19% |

| Norges Bank Investment Management | 14,100,744 | 1.71% | BlackRock Fund Advisors | 16,938,069 | 3.85% |

| State Street Global Advisors Ltd. | 13,990,546 | 1.69% | Massachusetts Financial Services Co. | 14,319,095 | 3.25% |

| BlackRock Fund Advisors | 13,399,616 | 1.62% | Glenview Capital Management LLC | 14,078,428 | 3.20% |

| Massachusetts Financial Services Co. | 13,024,482 | 1.58% | Fidelity Management & Research Co. | 13,454,547 | 3.06% |

| BlackRock Asset Management Deutschland AG | 12,404,565 | 1.50% | Sands Capital Management LLC | 11,854,253 | 2.69% |

| Amundi Asset Management SA (Investment Management) | 10,021,629 | 1.21% | PRIMECAP Management Co. | 11,630,397 | 2.64% |

| Dodge & Cox | 8,718,170 | 1.05% | Davis Selected Advisers LP | 8,233,266 | 1.87% |

Instead of participating in the CCI investigation, Monsanto has challenged the CCI in the courts. (Writ Petition filed on 27th feb 2016 and amended Writ Petition (WP (c) N 7578 of 2016)).

This is the highest level of disregard for the Competition Commission. Monsanto states that “the impugned orders are arbitrary in nature and have been passed without jurisdiction and is in complete violation of the principles of Natural justice”. Not only is the authority and jurisdiction of the Competition Commission being challenged, Monsanto’s authority (and by extension Bayer’s), is being established in its stead. Monsanto (Bayer) are questioning the jurisdiction of the Competition Commission of India in cases of monopoly, and questioning the institutions ability to adhere to “principles of natural justice”, simply because the Competition Commission of India is carrying out its duty. This arrogance can not be allowed to undermine India any further.

The abuse of this dominant position, to exploit farmers and even challenge the CCI and all laws and policies of India, will increase, not decrease, with the proposed combination. The Combination, if allowed, will be given a green signal to further violate all national laws with impunity. The rejection of the proposed combination is vital for upholding our laws, protecting our national sovereignty and the seed sovereignty of our farmers. The rejection of the combination, preventing the extension of Monsanto’s cotton monopoly into other crops, will also protect India’s food security and, therefore, our national security.

The combination needs to be assessed in the context the CCI investigation as well as the corporations abusing their dominant position by functioning as if they are above the law. The combination will increase the dominant position of Bayer and Monsanto, the use of that dominant position to repeatedly violate laws and policies of the land and undermining institutions of the land that protect India’s interests.

Monopoly – Monsanto has established a monopoly in Bt Cotton. The case of unfair prices of Bt Cotton seed was first investigated by MRTP. Now CCI is investigating the case.

On 10 May 2006, the MRTPC ruled in favour of the Andhra Pradesh farmers group and AP government, and directed Monsanto Mahyco Biotech Ltd. (MMB) to reduce the trait value it was unfairly charging the farmers of Andhra Pradesh. I had intervened in this case on Monsanto’s seed monopoly.

Following this, on 29 May 2006, the Andhra Pradesh Agricultural Commissioner fixed the price of Bt Cotton seeds at INR 750 for a 450-gram packet, and directed MMB and its sub-licensees to comply with its order. Monsanto challenged the Andhra Pradesh Government and the MRTPC’s decision in the Supreme Court, saying that the government’s move was illegal and arbitrary. The Supreme Court did not stay the MRTPC’s order, but while the appeal was pending before it, five states — Karnataka, Tamil Nadu, Gujarat, West Bengal, and Madhya Pradesh (now Maharashtra as well)— followed Andhra Pradesh’s lead and ordered that Bt Cotton should be sold at a reduced price.

It is in this background that, first the MRTP and now the Central Govt, has ordered a lowering of seed prices, most of which was royalty to Monsanto, even though Monsanto did not actually hold a valid patent on Bt cotton when it entered India illegally in 1998, and obtained commercial approval only in 2002.

As recorded in the Competition Commission proceedings “The ‘Trait Value’ is the estimated value for the trait of insect resistance conferred by the Bt gene technology. It forms a significant portion of the Bt cotton seed prices. It is stated that the trait value is determined by MMBL on the basis of Maximum Retail Price (MRP) of 450 gm seed packet (hereinafter ‘per packet’), in advance for each crop season. It is also stated that out of this trait value, some amount is disbursed as royalty to MIU

It transpires from the facts placed before the Commission that the fixation of trait value has been a matter of dispute/litigation since 2005. It is alleged that in the year 2005, the trait value fixed by MMBL was Rs.1250/- per packet for BG- I which led to high value of Bt cotton seeds manufactured using the said technology i.e. Rs.1700/- – Rs.1800/- per packet. This was allegedly very high in comparison to the price of non-Bt cotton seeds which were available for Rs.300/- per packet.”

(Ref. Case No. 02/2015 & Case No 107/2015 Page 4 of 26)

Monsanto has established a monopoly on cotton seeds, and through the monopoly enslaved farmers in debt and distress. Monsanto has violated the Anti Trust laws of India and the orders of the Monopoly and Restrictive Trade Practices Commission. It has tried to block the investigation by the Competition Commission of India of its 99% monopoly on the cotton seed market.

Not only has Monsanto violated Indian laws for Biosafety, Intellectual Property and Patents, and Access to Essential Commodities, including seed, it has threatened sovereign institutions and government with legal actions to subvert and undermine laws.

Monsanto’s crime is not just violating laws, but challenging laws and institutions that try to regulate Monsanto and stop its violations. These laws and institutions are pillars of Indian democracy and have been created to implement the Indian Constitution and protect people’s rights and the environment. The Company has challenged government when it tried to control seed prices, it has tried to challenge the Competition Commission when it tried to examine the cotton seed monopoly, and it is now challenging Art 3j of the Indian Patent Act which excludes seeds, plants, and animals from patentability.

In other words, Monsanto, now Bayer, wants absolute rights to operate illegally, demanding the freedom and right to rob farmers of their lives, through making false, selling failed technologies, and illegally collecting royalties. This is violative of Article 21 of the Indian Constitution.

On grounds listed above the combination of Bayer with Monsanto must be stopped under Section 3 and 4 of the Competition Act .

2) IPR Facts vs False Claims

Article 3j of India’s Patent Law does not allow patents on seeds : Monsanto’s claims to patents on Bt Cotton are false and illegal.

Violation of National laws related to Seeds and Patents to establish Monopoly .

Monsanto has made IPR issues central to the investigation of its monopoly on Bt cotton by challenging the CCI order of 10.02.2016 in Reference Case no 02/2015 on the false grounds that it has a patent on Bt Cotton seed.

Monsanto -which is being acquired by Bayer – has been systematically distorting the science of the seed and misrepresenting India’s patent law, making false IPR claims in establishing their monopoly. False claims to patents on seed are central to Monsanto seed monopoly.

Monsanto cannot and does not have a patent on Bt Cotton seed, Its patent is for a lab technique for adding a Bt gene (or two Bt genes in the case of Bollgard II) to an existing cotton plant.

India’s Patent Act excludes seeds, plants and animals from “inventions”.

That is why article 3j of India’s Patent Act prohibits patents on seeds.

Article 3(j) excludes from patentability “plants and animals in whole or in any part thereof other than microorganisns but including seeds, varieties, and species, and essentially biological processes for production or propagation of plants and animals”.

Section 3(h) of the Indian Patent Act, excludes from patentability a method of agriculture or horticulture.

Our laws recognise that adding a gene to a seed is not an “invention” of the seed. Seeds are not machines, they are self organised living systems that evolve, reproduce, multiply and renew. They can be manipulated, not “invented”. Changing the tiles of a bathroom floor in a house is neither the making of the house, nor the basis of its ownership, and with ownership, the right to collect rents, royalties, trait fees (which are different names for lagaan).

India’s Patent Law is clear. Life forms are not inventions and hence not patentable.

The Government has reiterated again and again that Monsanto does not have a patent in India

Monsanto has falsely defined seed to be their “invention” and seen such scientifically unjustified claims as their route to monopoly over seed.

Monsanto has admitted on record that it wrote the TRIPs agreement, for it’s own benefit. James Enyart of Monsanto is on record at a conference illustrating just how deeply the TRIPs agreement was supposed to be aligned to corporate interest and against the interests of farmers, nations and their citizens:

“Industry has identified a major problem for international trade. It crafted a solution, reduced it to a concrete proposal and sold it to our own and other governments… The industries and traders of world commerce have played simultaneously the role of patients, the diagnosticians and the prescribing physicians.”

Monsanto and Bayer Monsanto are still trying to be the “patient, diagnosticians and prescribing physicians” when it comes to seed and rights to seed. They are also now trying to be the hospital.

First Monsanto cooked up Patents on seed, falsely claiming that by changing a gene, they were creating the seed and all its future generations, and tried to introduce this illusion in the TRIPS agreement. We were successful in excluding life forms from patentability in TRIPS and in India’s Patent Act.

Indian negotiators at GATT – which later became WTO – ensured two changes in the draft imposed by Monsanto and other corporations. Firstly, we added the exclusion clause for living organisms including plants and animals. This is how India introduced Article 3j in its Patent Act. We also added the sui generis option for plant variety protection. This is how we evolved India’s Plant Variety Protection and Farmers Rights Act which recognises Farmers Rights.

a farmer shall be deemed to be entitled to save, use, sow, resow, exchange, share or sell his farm produce including seed of a variety protected under this Act in the same manner as he was entitled before the coming into force of this Act

India’s IPR laws are TRIPS consistent. Monsanto cannot and does have patents on Seed, including Bt Cotton seeds – for which royalty has been collected illegally for 2 decades.

When Monsanto applied for a patent on Bt Cotton in May 1st 2001, Monsanto had 59 Claims . The patent examiner asked them to remove all claims in the patent application related to plants and seeds since article 3j of the patent law does not allow patents on seeds and plants. The claims deleted under 3j in Monsanto’s patent application patent were 1-40, 48-56,57,58.. related to seeds and plants have been deleted subsequent to two examinations by the Indian Patent Office. Monsanto’s patents IN 214436 is on a method of transformation not on transgenic Bt Cotton plants and seeds . The summary of deleted claims related to seeds plants in Patent No 214436 is attached as Appendix 1

Inspite of only having a patent on a method lab transformation , not on seed, Monsanto , now Bayer , continue to falsely claim a right that our laws , and science , do not allow.

Besides falsely claiming patents on Bt Cotton Seeds , Monsanto is distorting science by referring to Bt genes as a “Technology “.

Bt is a gene (from a soil bacterium bacillus thurengensis ), not a technology . Genetic Engineering is the technology through which a gene of a bacteria has been added to a plant,in this case cotton .

Unlike other technologies, where the technology of production and the product are separable, in the case of genetically modified (GMO) seed, like Bt cotton, the Bt gene, once introduced into the seed through genetic engineering in the lab , becomes part of the seed which produces and reproduces itself as a biological organism , not as a machine . The Bt gene – which Monsanto misleadingly calls “technology” and “technology trait” – becomes part of the Bt cotton seed. It is not separable from it. On the same scientific basis, the “technology fees” charged for the “technology trait” of Bt is intrinsic to the price of seed that the farmer pays. The technology fees and seed price – which includes that fees – are not separable.

Monsanto is not licensing to Indian seed companies the use of tools of genetic engineering (used for introducing genes from non related organisms into a plant). These tools are only two: a gene gun, or an agrobacterium. What Monsanto is transferring to Indian companies is not the technology for creating transgenic plants, but the Bt cotton seed – which includes the genes within the seed – to multiply, hybridise and sell under their monopoly. So the mystification through the use of the term “technology trait” and “technology fees “ is hiding the fact that the cases including the present application for a combination is about Seed, and the price of Seed. And the price of seed has become a life and death issue for Indian farmers.

For two decades Monsanto has been making every effort to establish a monopoly through the false claim that it has a patent on Bt Cotton in India .

- The collection of illegal royalties from farmers is based on the unfair , untruthful agreements Monsanto signed with Indian companies on the false claim to patents on seed

Knowing that Monsanto could not have a patent on Seeds, including genetically engineered Bt Cotton Seeds Monsanto misled Indian seed Companies that it had a patent and locked them into unfair licensing arrangements which led to Monsanto controlling 95% of the Bt Cotton Seed market.

Monsanto falsely claims patent rights to seed in the sub licensing agreements with Indian seed companies

1.24 of the agreement signed with Rasi seeds on 1st feb 2015 clearly states “Monsanto Patent Rights” shall mean all patents relevant to Hybrid Cotton Planting Seed containing the Monsanto technology and any patent application or issued patent in the US or any other country or jurisdiction , as well as any extension or other government actions which extend any of the subject matter of such patent application or patent , and any substitutions, confirmations , registrations , or revalidations of any of the foregoing , in each case , that are owned or controlled by Monsanto Company or its affiliates “

The licensing agreements which have established Monsanto’ s monopoly on Bt Cotton in India are based on the illegal claim that patents in the US apply in India .

Patent laws are sovereign laws . India has its own patent Act . US law and US patents do not become applicable in India. That is why companies have to apply for patents in the Indian Patent Office , and the Indian patent office grants patents according to Indian Patent Law . Since Indian Patent law through article 3 j excludes patents on seeds and plants , Monsanto does not have a patent on Bt Cotton seeds , only on the technology of transformation in the lab.

It is through the false claim to patents that Monsanto locked Indian farmers through the Indian seed industry into dependence on Bt cotton and collected illegal royalties from Indian farmers, trapping them in debt and in many cases debt trapped farmers committed suicide.

Monsanto continues to behave as if it can write laws for establishing its monopoly on the vital sector of seed in India. This is what this case is about. Its license agreements state that Monsanto patent Rights which will govern the contract include Rights granted in the USA. Thus through writing contracts on false grounds , both in terms of its non existent patents on Bt Cotton seed in India, and the false claims that Bt Cotton will control pests and farmers will not need to spray . it is subverting India’s laws, including Intellectual Property Rights related to seed and plants, Biosafety laws , essential commodities act , and trhe Competion Act

When it introduced Bt I, it had no patent. The trait value collected was therefore illegal.

It did get a patent for Bollgard II , but not for the seed ,only the transgenic transformation in the lab.

As recorded in the proceedings of the competition commission ,

“Monsanto Holding Private Limited (MHPL) is a 100% subsidiary of Monsanto Inc USA (MIU) in India and it is engaged in marketing of Bt cotton hybrid seeds (trade name–Paras) and other field crop seeds. MAHYCO is also an Indian company, engaged in research and development, production, processing and marketing of hybrid seeds and open pollinated seeds in India. MHPL holds 26% stake in MAHYCO. Monsanto Mahyco Biotech Ltd (MMBL) is a 50:50 joint venture formed between MHPL and MAHYCO and is engaged in sub- licensing of Bt cotton technology of MIU in India.

In 1998, MIU licensed its Bt cotton technology to MMBL for further sub- licensing by it to seed manufacturers in India, to incorporate this technology in the existing cotton seeds/ hybrids manufactured by Indian seed manufacturing companies. As per the facts made available, first sub-licensing took place in 1999 and it was subsequently renewed as per the terms of various agreements between MMBL and Indian seed companies. The resultant modified seeds were claimed to possess insect resistant traits termed as Bt cotton seeds. In India, substances and products which contain genetically engineered organisms can be produced, sold, imported or used only with the approval of Genetic Engineering Appraisal Committee (GEAC). It is stated that BG-I was approved for commercialisation by GEAC in 2002 whereas, BG-II was approved for commercialisation in 2006.

Inspite of not having a patent, Monsanto started to collect royalties on its illegally introduced Bt cotton .It collected an upfront , one time nonrefundable fee of Rs 50 lakh from each licensee and a recurring fee . Since it did not have a patent , it cooked up a category called “Technology Trait” to collect a “trait fee”, just another name for royalty . This royalty is finally extracted from poor farmers.

India’s peasants are too small and too many to do contracts for a non existant IPR . So Monsanto locked in Indian seed companies to collect royalties on Monsanto’s behalf –very much like the British arbitrarily appointed Zamindars to collect taxes and revenues for peasants in colonial times, ruining a rich and prosperous land and leaving us in poverty and destitution .

Such agreements are illegal because when Monsanto locked Indian companies into these agreements to extract royalties and trait fees , it had no approval for commercial planting .And it did not, and cannot have patents on seed under Indian Patent Law .US patents do not apply in India

The agreements are fraudulent , and Indian famers , Indian seed companies , and India have been cheated by extracting “royalties” on the basis of a non existent right.

In 1999 Monsanto did not have commercial approval for Bt cotton . By signing agreements for licensing before approval , Monsanto was engaging in illegal action .

Patent laws are sovereign laws . Patents issued in the US do not apply in India . Monsanto violated Indian laws by claiming patent rights in India falsely.These false claims are liable for penalty .

Secondly, Monsanto changes its Technology trait value every season, showing again that the issue is seed price. As the Competition Commission of India records:

Many Indian seed companies entered into sub-license agreement with MMBL for procuring its Bt cotton technology in consideration of an upfront one time non–refundable fee of Rs. 50 lakhs and recurring fee called as, i.e. ‘Trait Value’. The ‘Trait Value’ is the estimated value for the trait of insect resistance conferred by the Bt gene technology. It forms a significant portion of the Bt cotton seed prices. It is stated that the trait value is determined by MMBL on the basis of Maximum Retail Price (MRP) of 450 gm seed packet (hereinafter ‘per packet’), in advance for each crop season. It is also stated that out of this trait value, some amount is disbursed as royalty to MIU and the royalty paid to Monsanto US by MMBL is a small portion (between 15-20%) of the Trait Value it collects.

Once an upfront fees has been paid for seeds with a Bt toxin trait, the “technology fees “ is an unfair, greedy means of increasing seed prices to increase profits in a monopoly market. The MRTPC had also made this observation forcing Monsanto to concoct “Trait Fees”.

The licensing agreements allowed Monsanto to illegally collect super profits from farmers , trapping them in debt , pushing thousands to suicide.

- Monsanto has been illegally collecting royalties from farmers via Indian seed companies by falsely claiming that it had a patent on Bt Cotton, even though India’s patent laws, specially Article 3 j , do not allow patents on seeds . The illegal collection of royalties from poor farmers have driven farmers to debt and suicide.

Monsanto is now trying to challenge article 3 j of India’s Patent Act through the commercial case No 132 /2016 .

I have had to intervene in the proceedings to uphold our Patent Act and farmers rights . My submission to the High Court of Delhi in Civil Appeal 4086 of 2016 related to article 3 j is added as Appendix 2.

- Even in the case of the CCI order of 10.02.2016 in Reference Case no 02/2015 and case number 107/2015 on monopoly over Bt Cotton Seed , Monsanto is using its non existent patents on Bt Cotton Seed to challenge the order of CCI in the High Court. Pg 1 of the WP submitted on 27th Feb 2016 states that CCI cannot investigate a prima facie case of monopoly because of Monsanto’s “right to license the Intellectual Property Rights which vest in its favour .ie right in the patent being IN 214436 in respect of Genetically Modified Hybrid Cotton Seeds and in the Trade Marks “Bollgard” & BOLLGARD II” and to prevent unauthorized use thereof “

The Indian Patent Act and article 3j are clear on Monsanto’s patent covering a tool of genetic engineering , not the seed and plant itself .

If CCI allows the combination to go through ,it is in fact giving a green signal to Bayer and Monsanto that they can ignore Art 3j of the Indian Patent Act and ignore orders of the CCI . The approval of the combination will be an approval to establish absolute monopoly in the vital area of seed with total disdain for Indian laws , institutions and the Constitution . The CCI needs to take these far reaching consequences into account .

- In the challenge to the Seed Price Control order of the Government in the High Court of Karnataka, Monsanto through its Association , ABLE , again tried to mislead the court that the Indian Patent Act allows Patents in Seed , and regulating seed prices is violative of the TRIPS agreement .

Monsanto/ABLE made the far-fetched claim that the order violates International treaties, like “TRIPS, that India is a signatory to in as much as they seek to impose an arbitrary restriction on commercial usage of the proprietary intellectual properties of the agri- biotechnology companies”.

This too is false and misleading. Indian’s laws are consistent with the TRIPs agreement of the WTO, yet protect the public interest and national interest. This flexibility is provided in Article 27 of the TRIPS agreement.

- Subject to the provisions of paragraphs 2 and 3, patents shall be available for any inventions, whether products or processes, in all fields of technology, provided that they are new, involve an inventive step and are capable of industrial application. (5) Subject to paragraph 4 of Article 65, paragraph 8 of Article 70 and paragraph 3 of this Article, patents shall be available and patent rights enjoyable without discrimination as to the place of invention, the field of technology and whether products are imported or locally produced.

- Members may exclude from patentability inventions, the prevention within their territory of the commercial exploitation of which is necessary to protect ordre public or morality, including to protect human, animal or plant life or health or to avoid serious prejudice to the environment, provided that such exclusion is not made merely because the exploitation is prohibited by their law.

- Members may also exclude from patentability:

a) diagnostic, therapeutic and surgical methods for the treatment of humans or animals;

b) plants and animals other than micro-organisms, and essentially biological processes for the production of plants or animals other than non-biological and microbiological processes. However, Members shall provide for the protection of plant varieties either by patents or by an effective sui generis system or by any combination thereof. The provisions of this subparagraph shall be reviewed four years after the date of entry into force of the WTO Agreement.

The Bayer application for a combination with Monsanto hides the misleading statements on IPRs made in the Karnataka High Court and also omits the order of the High Court of Karnataka that dismissed the ABLE petition and uphold the Seed Price Control order of government in para 24 where it refers to the seed price control order .

Both Bayer and Monsanto have been using their dominant position in agrochemicals to genetically engineer seeds to take patents.

Both Bayer and Monsanto have their origins in chemicals. They have entered the seed sector through genetic engineering and integrating their chemicals with seeds.

The statement made by Bayer In para 77 of its summary application Bayer that “technical and commercial bundling of GM seeds with certain crop protection products is neither possible nor probable” is scientifically false. Bayer’s Glufosinate tolerant crops, and Monsanto’s Round Resistant crops are examples of bundling of chemicals with seeds.

In fact it is this bundling that has allowed Bayer and Monsanto to dominate over seed companies that have an older history. In the race for mergers and acquisitions in the seed/agrichemical sectors, both Monsanto and Bayer have been merging their chemical products with seeds through genetically engineered seeds.

The application is full of scientifically and technically false claims and therefore liable for penalty.

For example in para 42 it is stated “open pollinated and hybrid varieties may be interchangeably used by farmers and are substitutable products”.

This is biologically and commercially not true. Farmers’ open pollinated varieties are different from hybrid varieties because open pollinated varieties can be saved and reused, giving farmers freedom to carry out their trade without dependence on costly external inputs, while hybrid varieties do not breed true and have to be purchased every year at high prices, increasing the cost for farmers.

The open pollinated seeds were available for Rs 5-10 before Monsanto established its monopoly. If the farmers had their own seed, it was zero cost. Monsanto increased the price of Bt hybrids to Rs 1650 for a 50 gm packet . The prices were later lowered with the intervention of the MRTP commission and later the Seed Price Control order.

3 Attempt to challenge the Seed Price Control Order, the Implemention of the Essential Commodity Act , False Claims and Omission : Bayer Liable to penalty under section 44 and 45 of the Competition Act

When the collection of illegal royalties and “trait fees” was finally stopped by government through a Seed Price Control order in 2015, Monsanto tried to challenge it, further violating farmers rights, and thinking it is above democracy and laws.

Monsanto challenged the Seed Price Control order through the Biotechnology group ABLE of which it is a member ,and I had to intervene in the High Court of Karnataka to have their challenge dismissed so that the Seed Price Control Order stands . ( Writ petition nos 1125 -1126 /2016 )

When the Government passed the Seed Price Control Order , it was followed up with guidelines from the Ministry of Agriculture to clarify Indian law related to Patents and breeders rights , and the exclusions from patentability of seed through Art 3j. Monsanto manipulated to block the notification of the guidelines . Bayer is now using this manipulation to apply for a combination . In para 2 of the application it omits mentioning the decision of the Karnataka High Court upholding the Seed Price Control Order ,but goes out of its way to mention in footnote 11 on pg 8 of the application to mention how the guidelines were not notified .

In para 24 ,of its application for combination ,Bayer states

“it should be mentioned that the licensing of cotton traits and technology, is regulated by the Government in terms of prices and potentially even the terms of licensing agreements.11 This regulation significantly limits the commercial freedom of any owner of the Bollgard II technology.”

Abuse of dominant position through claiming unconditional rights in violation of national laws is not “limiting commercial freedom “ but preventing anti competitive practices and protecting the freedom of farmers to be free of exploitation by monopoly .

Creating legal confusion through manipulation, distortion, false claims related to IPRs and Patents is the Bayer /Monsanto strategy for creating monopoly on seed . This is in violation of section 44 and 45 of the Competition Act and Bayer Monsanto are liable to a penalty .The commission needs to impose the penalty , and prevent the combination .

The ABLE Writ made false claims.

1) It says the Seed Price control order suffers from “several legal and technical infirmities and likely to significantly impede research and development, undercut competition, pose a huge setback to the progress of the biotech industry and chill innovation”.

The reality is that the Monsanto company has created its laws, defined its own rules, outside the law of the land. Now, Monsanto rules are coming in direct conflict with the Govt acting in accordance with its duty – to protect the public interest and the national interest.

No commercial interest can act outside of the law. Even commercial contracts have to be within the boundary conditions of justice and fundamental rights of people set by our constitution. The right to profit is not absolute. It is limited by the human rights of citizens as defined in the constitution. The issue of the price of seed as an essential commodity which farmers can afford and which is reliable, has to be settled in the context of farmers fundamental rights and the duty of government to protect the life and livelihood of farmers. It cannot be decided arbitrarily by Monsanto with the sole objective of maximising its own profits, at the cost of farmers lives.

This is what the Seed Price Control order has done. The HC has upheld the Government of India’s Cotton Seeds Price (Control) Order, 2015. But a doubt has been created by Monsanto represented by ABLE on “trait value” of Bt cotton seed.

Monsanto is misleading CCI and the multiple courts it is attempting to abuse in order to establish its monopoly in many ways:

Contracts

It is saying the contracts for GMO Bt cotton seed are beyond the laws of the land.

No contract can violate the law. If organ trade is illegal in India, two contracting parties cannot write an agreement and carry out organ trade. Such contracts would be illegal.

Indian Seed Companies

It is making the court think that it has a patent on Bt cotton seed and the issue of “trait value” is agreed to by Monsanto and its sub licensees – the Indian seed companies.

However, it is the Indian seed companies which stopped paying royalties to Monsanto on grounds that these royalties were exorbitant and unreasonable. Monsanto is attacking the Indian seed companies as well, unilaterally cancelling those very agreements. http://www.ft.com/intl/cms/s/0/7197ffa8-7551-11e5-a95a-27d368e1ddf7.html http://economictimes.indiatimes.com/news/economy/agriculture/royalty-payments-indian-seed- makers-to-take-on-monsanto/articleshow/49347160.cms http://economictimes.indiatimes.com/news/politics-and-nation/high-court-stops-nuziveedu-seeds- from-selling-bt-cotton-under-monsanto-brand/articleshow/51060790.cms

It must be noted, the one sided agreements imposed on the seed industry, only the Sublicensor, i.e. Monsanto via Monsanto Mahyco , has the right to terminate the sublicense agreements. This is not a contract between 2 companies, it’s slavery.

Absolute Power

The company cannot argue that Monsanto has absolute power to define seed prices and trait value. The farmers, Indian licensees, and the government are all saying that Monsanto’s power is not higher than that of farmers, Indian Companies, the Government of India, and laws written by a sovereign democratic government under India’s Constitution.

http://buenosairesherald.com/article/210103/government-set-to-step-into-monsanto-row

http://economictimes.indiatimes.com/markets/stocks/news/monsanto-india-slumps-as-

karanataka-hc-allows-govt-to-set-msp/articleshow/51579978.cms?from=mdr

Essential Commodities Act

It is arguing that the essential commodity act does not cover GMO seeds and Monsanto’s royalty. Just as Monsanto is claiming that, as a corporation, it is not governed by India’s laws, it is claiming that its products are beyond the law as well. GMO seeds are still seeds and since seeds are essential commodities, all seeds, irrespective of method of production are covered by the law. The law does not say “open pollinated seed”, “farmers varieties”, “public varieties”, “hybrid seeds” – it pertains to all seeds. GMO seeds are covered by the essential commodities act, as all seeds, and all essential commodities are.

Costs of Seed Production

Monsanto is also misleading the courts in stating that the trait value covers all costs of research, development, seed production, sale, seed purity. The license agreement makes it clear that these costs are all born by the Indian sublicensees, who are demanding a reduction of royalty.

Monsanto does not incur any costs in the production, multiplication, distribution, marketing and sale of Bt cotton seed. All costs “towards the production of Genetically Modified Hybrid Cotton Planting Seed” and “all other activities reasonably necessary for the production, ginning, delinting, processing and sale of Genetically Modified Hybrid Cotton Planting Seed” are paid by the sublicensee – the Indian seed company, including tests and reports mandated by Monsanto. The Genetically Modified Hybrid Cotton Planting Seed referred to in the sublicense agreement, is thus, produced by Indian seed companies.

Since Monsanto does not incur any cost from the manufacture and sale of Bt cotton in India, the company is lax about it’s accounting, making the Indian companies do that as well – including the calculation of ‘Running Fees’ according to a prescribed formula.

Monsanto is stating that the Seed Price Control order will undermine competition. Monsanto has destroyed competition and established a monopoly through Bt cotton. That is why the case is in the Competition Commission of India. “MMBL’s agreements with its licencees were “stringent and unfair”, MMBL can terminate its agreements with the licencees at any time if laws were passed to regulate trait fees. Such terms discouraged licencees from going to competitors of MMBL and restricted development of alternative technologies”, the CCI has said, adding that Monsanto abused its dominant position as a supplier of genetically modified (GM) cotton seeds in India and has issued an order citing prima facie violation of Sections 3(4) and 4 of the Competition Act, to be investigated by CCI’s director-general.

The Seed Price control order will in fact increase competition by allowing more diversity of players as well as seeds in the market.

Monsanto is arguing that the order will “chill” innovation. Monsanto introduced Bt cotton on claims of controlling the bollworm. Bt I failed to control the bollworm, it introduced Bt II. This too has evolved resistance. Monsanto’s 20 year failure to innovate has ‘chilled’ innovation, not the Seed Price Control order. Einstein had said – “A clear sign of insanity is doing the same thing over and over again, expecting a different outcome”.

The Bt gene, for which Monsanto has charged royalty without having a patent, produces Bt toxin in each cell of the plant. This Bt toxin is what is supposed to control pink bollworm attack on the cotton crop. Both Bollgard I and Bollgard II have lost their efficacy in controlling the pink bollworm. At least 40 % of the Bt Cotton crop was destroyed by pink bollworm in 2015. The “Technology Fees” is being charged for the “Technology Trait” – which has failed globally.

Monsanto has in fact been served notice for revocation of the claim that Bt Cotton traits control pests

http://ssrana.in/Admin/UploadDocument/IP Updates/INDIA-Monsanto-Served-Notice-for-Revocation-of-its-Bt-Cotton-Patent.htm

Monsanto tried to challenge the Seed Price Control Order , and continues to threaten Government to get it withdrawn .

Monsanto continues to try to undermine the seed price control order by putting pressure on government

4 False claims on withdrawal of Round Up Ready Bt Cotton

In para 36 Bayer states “The application for approval of Bollgard II / Roundup Ready flex trait was also withdrawn by Monsanto in India. Therefore, the Parties do not have any presence in this segment of the market in India.”

Firstly , the Mahyco letter of 6.7.16 ,( Appendix 3 ) representing Monsanto on the withdrawn of the application for Roundup Ready Bt cotton clearly states that it retains the freedom to renew “the aforesaid application at a suitable time “ . This cannot be seen as a permanent withdrawal.The letter is in effect a pressure to get the Seed Price Control order withdrawn .

The letter states “Regretably, due to certain dramatic recent developments, we have been compelled to reevaluate the pursuit of one application. One such key development , the recently proposed change in laws relating to licensing of technologies such as Bollgard technologies has alarmed us and we raised serious concerns about the protection of intellectual property rights associated with such technologies . Whereas technology providers and their licensees were earlier able to negotiate license terms, recently proposed guidelines /notifications issued pursuant to Essential Commodities Act 1955 provide for fixing of license fee “.

Thus the letter cited by Bayer in the application to justify the combination continues to be an attempt to undermine our national laws to establish a monopoly . Firstly, Seed Price Control Order is an order , not a law . The law it is implementing is the Essential Commodities act ,and the IPR laws of the country that do not grant patents on seed . There has been no change in law . Only an end to the regime of Monsanto’s illegal royalty collect ions for a patent it is not allowed to have under Indian law .Through the letter Monsanto/Mahyco , and now Bayer , are trying to continue the lawlessnees through which they have exploited Indian farmers.

Further, the letter also continues the trend set by Monsanto of illegal introduction of its GMO seeds.

It is more a cover up of the illegal spread of Round up Ready Bt Cotton which has been established by the Central Cotton Research Institute .

The Telangana government has called attention of the Central government to the issue ,

Farmers of Andhra Pradesh have brought attention of the courts (WP 38579 of 2017 and WP 38613 0f 2017 )

So the claim in the application of withdrawal of Round up Ready Bt Cotton which is being cited in the application for the combination is again a false claim, which is liable for penalty under Section 444. The letter is only to

- cover up the illegal spread of RoundUp Ready Bt Cotton and

- to put pressure on government on the Seed Price Regulation, and the continued pressure to undo article 3 j of India’s Patent laws through false claims to Patents and Intellectual Property Rights to Seed.

Para 35 is also misleading in light of the fact that Monsanto is illegally already spreading its Roundup Ready Bt cotton without approval. Further, the GMO mustard is based on resistance to Bayers Glufosinate. It is not true that “no regulating approvals for entering this market is pending before any government authority.”

The claim made in para 16, 17 and para 20, that Bayer is spinning off its GMO business to BASF, and hence there is no overlap is also hiding the fact that Monsanto has many licensing agreements with BASF and hence the proposed combination will lead to anti competitive behaviour in the vital area of our seed and food. Monsanto’s Licensing agreements with BASF need to be included in the assessment of the proposed combination.

Since the merger of Bayer-Monsanto will lead to change of control from Monsanto to Bayer, the monopoly is transferred to Bayer, and Capital from the US to Germany. Further Monsanto has licensing arrangements with BASF to who Bayer is divesting its global GM traits (Diagram 1)

In short 20 years Monsanto established a monopoly in Bt Cotton. If the merger of Bayer Monsanto is allowed to go through, similar monopolies in each seed supply chain will be established. The moratorium on Bt Brinjal and the Supreme Court case on GMO mustard – which has been engineered to be resistant to Bayer’s Glufosinate- have been reasons that the accelerated takeover of seeds besides cotton has not taken place.

In a short 2 decades from having no role in the seed business Bayer and Monsanto have emerged as major giants. The proposed Mega Merger will enhance the dominant position of the players and allow them to subvert and undermine all regulations that protect our biodiversity, our farmers, our society, and our country. Given the two decade history of illegal processes to establish monopoly on seed, push agrichemicals and GMOs known to harmful to environment and public health, the merger will be a major threat to Indian farmers, to Indian Agriculture.

Monsanto and Bayer are buying up smaller seed companies, or locking them into unfair licensing contracts.

Since the 1990’s these seed and chemical giants have been trying to prevent farmers from saving and exchanging seed by manipulating Intellectual Property Rights.

Thirdly, Bayer and Monsanto have been buying up local seed industries In 1the last two decades (Diagram I ) They are among the few corporations controlling the seed sector and through control of seeds and agrochemicals , controlling agriculture

Further Monsanto is recklessly spreading Roundup and Roundup resistant Bt Cotton in India even though Round up is known to be a carcinogen and is implicated in the kidney disease in SriLanka. SriLanka has banned Roundup. This a threat to consumer health and safety. It has also been recognised as a carcinogen by the World Health Organisation. The abuse of the dominant position to influence issues of safety has now been established in US Courts through the Monsanto papers.

5 The need for investigation of “Sale” of Monsanto cotton business to Tierra Agrotech

Bayer is trying to present to the Competition Commission that Monsanto has no monopoly in the Cotton seed sector, an issue already under investigation by the CCI. Seed is living and a continuum. The introduction of a gene in the genome of a seed through the tools and technology of genetic engineering becomes part of the seed.

It is not possible to separate “upstream market for licensing of traits and technology” from “downstream market for sale of cotton seed” Licensing agreements determine the price of seed and terms of production sale, distribution of the Bt Cotton seeds.

The construct of upstream and downstream is artificial and aimed only at hiding the reality of monopoly, manipulation and fraud.

The table on page 7 of the application, on the cotton seed market is misleading and a cover up, to allow the combination to go through. While the table admits that Monsanto has a 95-100 % share in licensing Bt Cotton traits, and only a 5 % share in branded seeds, all independent players who are tied up in Monsanto’s unfair licensing agreements have to sell Bt cotton with the trade name “Bollgard”. All the licensing agreements impose the use of the trade mark “Bollgard” in the down stream market, as the agreements state “sublicensee acknowledges Monsanto’s exclusive ownership of all right, title and interest in and to the BOLLGARD Trademark and agrees that the Bollgard trademark shall inure to the benefit of MONSANTO”

The upstream restrictions translate into downstream restrictions and are anti competitive, an issue that CCI is already investigating.

The latest fraud is the pretense that Monsanto has sold its cotton business to an unlisted private company incorporated on 13 September, 2013. The 4 year old company, Tierra Agrotech, which started with paid up capital of a mere Rs 100,000 is supposed to have purchased Monsanto’s cotton business. The company has no reported secured loans. The company has 2 directors/key management personnel.

The registered office of the company is at H. No. 1-62-192, 3rd Floor, Dwaraka Avenue, Kavuri Hills, Madhapur,, Hyderabad, Hyderabad, Telangana.

This farce of an acquisition to facilitate the Bayer Monsanto combination needs to be investigated.

As para 8 of the application for combination states:

“On 14 September 2016, the Parties entered into a definitive agreement and plan of merger by which the entire shareholding of Monsanto will be acquired by Bayer.”

A few days before, on 31 August 2017 Monsanto “sold” its cotton seed business to TIERRA AGROTECH PRIVATE LIMITED

In para 18. Bayer states “In addition, Monsanto, for reasons unrelated to the Proposed Combination, has executed an agreement dated 31 August 2017 for selling its branded cotton business to Tierra Agrotech Private Ltd and therefore there is no longer any horizontal overlap between the Parties in cotton seeds in India.”

In para 21 it reiterates “As stated above, the overlap between the Parties has been eliminated in the downstream market for sale of cotton seed in India further to Monsanto’s proposed sale of its branded cotton business to Tierra Agrotech Private Ltd (which was done for reasons unrelated to the Proposed Combination).

The CCI needs to investigate this fraud: the acquisition of Monsanto by Tierra which came into being only 4 years ago with a paid up capital of Rs 100000 in the light of existing monopolies and violations , this combination should not be allowed.

While Bayer repeatedly states that the sale of branded cotton seed business by Monsanto to Tierra is not related to the present proposal for combination , it clearly is related. The details of this sale should be fully investigated by CCI.

The last reported AGM (Annual General Meeting) of the company, per our records, was held on 30 September, 2016. Also, as per our records, its last balance sheet was prepared for the period ending on 31 March, 2016.

https://www.tofler.in/tierra-agrotech-private-limited/company/U01119TG2013PTC090004

https://economictimes.indiatimes.com/news/economy/agriculture/monsanto-exits-cotton-seeds-business-in-india/articleshow/60415874.cms

Monsanto purchased cotton seed business investing substantial capital of around Rs. 3000 Crores in the 90s. The cotton seed business of Hindustan Lever Seed Division, ITC Seed Division, Mahindra Seeds which was one of the leading cotton seed companies in the 80s and 90s were purchased by Emergent Genetics Limited which was ultimately merged into Monsanto Holdings Private Limited (MHPL) which is a 100% subsidiary of Monsanto Company, USA. Huge amounts were invested out of Monsanto Company towards this acquisition. The share in the cotton seed market of these companies when they were acquired was more than 25-30%.

Such valuable business was sold to an unknown entity known as Tierra Agrotech Private Limited for a negative business value by MHPL. The business value is negative because the valuation has been done at about Rs. 100/- per packet of cotton seed inventory whereas the cost of production is above Rs. 250/- per packet. This shows the business valuation is negative. The loss incurred by Monsanto Company, USA will be more than USD 1 billion. There was no transparent process that was run by MHPL and hardly anybody knew in the Seed Industry that Monsanto Company is selling their cotton seed business in India. There seems to be some adjustments in this process to benefit people like Mr. Nirula who is husband of Ms. Shilpa who is heading Monsanto’s Indian operations now, Mr. Sekhar Natarajan who was heading Monsanto India earlier and remains the Chairman of Monsanto India listed entity even now, Mr. Ram Kaundinya who is now a shareholder of Tierra Agrotech but who was MD of Emergent Genetics at the time of Monsanto Company purchased it and subsequently worked in MHPL for many years. The losses to the shareholders of Monsanto Company, USA needs to be investigated by the regulators there.

It is also evident that the loss of value incurred by MHPL (Monsanto Company) is an indirect payout for certain liaisoning and lobbying activities to be indulged by Monsanto so as to get approvals before Competition Commission for the merger with Bayer as well as to get certain favorable orders from GEAC, DBT and Ministry of Agriculture.

Monsanto has abused a dominant position it has created through scientifically and legally fraudulent claims.The Combination will amplify the fraud by giving more power to the combination which has a history of fraud and has made false claims in its application for the merger .

- False Claim and Omissions on mention of multiple conflicts with the Indian Seed Industry to justify combination

Monsanto is engaged in multiple litigations against Indian Seed Companies because of the exorbitant rent collections as trait fees , and because the trait is failing to control pests. In fact Indian companies are threatening to stop selling Bt Cotton seeds

http://www.thehindubusinessline.com/economy/agri-business/threat-to-stop-selling-bt-cotton-seeds-irresponsible-mahyco-monsanto/article10038022.ece

Bayer in para 26 is again hiding information of its ongoing conflicts with other players because of its unfair licensing agreement and unscientific claims about Bt Technology as a reliable pest control technology .

“26.There is no risk that the Proposed Combination could lead to the foreclosure of seed companies that compete with Bayer on the downstream market for Bt traited cotton seed. Even leaving aside the legal requirements resulting from the regulation, post-closing, Bayer would have no incentive to cease licensing the Bollgard® traits to rival seed companies. With less than 5 % of the cotton seed market in India the combined entity would unlikely be able to recoup the lost profits upstream by increased profits on the downstream seeds market as the combined entity’s downstream market share is negligible and the combined entity cannot expand capacity in a timely manner. Indeed, Monsanto has widely licensed its Bollgard II technology to cotton seed producers in India in the past even though Monsanto used to have an Indian cotton seeds business of its own. This shows that the fact of owning a downstream cotton seeds business does not enable or incentivize the owner of Bollgard II technology to foreclose other cotton seed companies. Accordingly, there is no reason to expect that the combined entity would have the ability or incentives to foreclose. “

This submission omits the multiple litigations and conflicts between Monsanto and Indian seed companies .

It is false for Bayer to claim that the licensing agreements with Indian companies are unproblematic. Without Indian companies to breed , produce , and distribute seeds Monsanto and Bayer have no business in Bt Cotton and the combination has no material grounds .CCI has multiple grounds to reject the combination .

Below are the existing Litigations between the Indian Seed industry and Monsanto

Litigations between NSL & MMBL

- Dispute & Arbitration proceedings

- The disputes with the MMBL have arisen because NSL was unable to collect and pay Trait Value as per the contract as various States have considered a much lower Trait Value (than the Trait Value under the sub-license agreements) while fixing the maximum sale price of seeds in their price notifications under statutes. However through abuse of its dominant position in trait market MMBL wanted much higher trait value due to which these disputes have arisen. The details are as follows:

| Particulars | Maharashtra

(Inc. taxes) |

Andhra Pradesh (AP) (Inc. taxes) | Telangana (Inc. taxes) | MMBL Trait Value demand (plus taxes) | ||||||

| BG I | BGII | BG I | BGII | BG I | BGII | BG I | BGII | |||

| Year 2010 | ||||||||||

| MRP | 650 | 750 | 650 | 750 | Part of AP before division | 96.15 | 150 | |||

| Trait value | 50 | 90 | 50 | 90 | ||||||

| Years 2011 to 2014 | ||||||||||

| MRP | 830 | 930 | 830 | 930 | Part of AP before division | 109.43 | 163.28 | |||

| Trait value | 20 | 20 | 50 | 90 | ||||||

| Year 2015 | ||||||||||

| MRP | 730 | 830 | 830 | 930 | 830 | 930 | 109.43 | 163.28 | ||

| Trait value | 20 | 20 | 50 | 90 | 10 | 50 | ||||

- In spite of the above position, NSL made payments to MMBL till financial year 2014-15 as per its demand on an adhoc basis as the price notifications challenges were pending before various courts.

- During 2015-16, the Nagpur Bench of Bombay High Court upheld the power of State Government to fix MRP and consider lower trait value than the contractually imposed Trait Value by MMBL, NSL and some other domestic seed companies made written representations to MMBL requesting them to consider charging Trait Value at the rates determined by State Governments and called on them to come for discussion to resolve the issue of Trait Value amicably and settle the accounts of previous periods by refunding the excess trait value collected during 2010-11 to 2014-15. However, MMBL rejected the request made by domestic seed companies and filed arbitration proceedings against the domestic seed companies claiming the trait value amount which was allegedly due and payable during the kharif 2015 season, despite itself holding hundreds of crores of excess amount, which it had collected from the domestic seed companies from Financial Years 2010-11 till 2014-15 and even ignoring the request of the respective domestic seed companies for reconciliation and refund of excess amount lying with MMBL. Further, while the arbitration proceedings were pending, MMBL issued termination notices dated November 14, 2015 to NSL and Group Companies.

- MMBL with mala fide intent opted a selective pick & choose and discriminatory policy by targeting only NSL, whereas other similarly placed domestic seed companies who were in similar position, have not been treated similarly by MMBL, to the effect that their agreements are not terminated.

- CCI Proceedings

- Aggrieved by the abusive conduct of MMBL, NSL and its two group companies filed information to the Hon’ble Competition Commission of India under Section 26 of the Competition Act alleging abuse of dominance and unfair and anti-competitive practices of MMBL and its group companies (Monsanto Group). Subsequently about five other seed companies and the National Seed Association of India and few farmer bodies also filed complaints against Monsanto Group. Before this Independent references were also made by the Department of Agriculture, Government of India and Government of Telangana against Monsanto Group. CCI clubbed all these cases and ordered investigation against MMBL and its parent companies.

- The Hon’ble Competition Commission of India vide its order dated February 10, 2016 has on a prima facie basis concluded that Monsanto Group contravened the provisions of Section 3(4) and Section 4 of the Competition Act and accordingly under the provisions of Section 26(1) of the Competition Act directed the Director General (DG) to cause an investigation into the matter. Apart from other allegations, the act MMBL i.e. termination of the 2015 Sub Licensing Agreements is also under investigation before CCI. In an interim application filed by NSL, CCI passed interim orders restraining MMBL from imposing post termination obligations against NSL. The Investigation is in process.

- Suit for Infringement of Patent and Trademark

- Monsanto Group filed a patent and trademark infringement suit before Hon’ble High Court of Delhi against Nuziveedu Seeds Limited, Prabhath Agri Genetics Limited and Pravardhan Seeds Private Limited (NSL seeds group) along with an application for interim orders praying for injunction order to stop Bt cotton seed sales by NSL seeds group with immediate effect on the ground of alleged termination of sub-license agreement in November 2015.

- The High Court passed an Interim order dated 28 March 2017 holding that MMBL charging trait value more than the government considered trait value was not correct and termination of agreement was also illegal and arbitrary and directed both parties to continue with the agreement. However the High Court prima facie held that Monsanto have patent rights on Bt. cotton seeds and directed us to pay trait value as per the notifications of the Government.

- The order of the single was challenged before the Division Bench of Delhi High Court, wherein the portion of the order on patent rights on Bt. cotton seeds was challenged by NSL and the portion of the order on restoration of agreement was challenged by Monsanto Group. Arguments of both parties were completed and the judgment was reserved on May 8, 2017.

- Meanwhile NSL discontinued with Bollgard II trademark of Monsanto Group on its Bt. cotton seed packets and is paying trait value @ Rs. 49/- as per the notifications issued by the Government in accordance with the directions of Hon’ble Delhi High Court.

These outstanding matters that are at the core of the proposed combination cannot be omiited either in the application for merger , or its assessment . Bayer false claims , misleading statements , and omissions are liable for a penalty under Section 44 and 45 of the Competition Act .

7 Bt Cotton Monopoly , violation of Farmers Rights , Extinguishing of farmers lives : An abuse of dominant position and violation of Section 4

The proposed combination is in the vital sector of seeds .

Any consideration of the impact of the combination on competition needs to be made in light of laws of the land related to seed and farmers rights , and the established violation of anti competition laws by the parties of the combination . The combination builds on two decades of creating a Bt Cotton Monopoly , extinguishing and violating Farmers Rights , and violation of rights of farmers as consumers.The farmers crisis created in the Bt cotton areas is a clear case of abuse of Dominant Position and Violation of Section 4 ;

Seed is the basis of agriculture. The means of production and the basis of livelihood for farmers. seed is the primary means of agricultural production , and the Right to Seed is central to Farmers Rights . Farmers are the original breeders who have given us the diversity of crops ands varieties which are the basis of all breeding.

The combination will impact farmers rights and the trade carried out by farmers. both in seed and their produce .

Besides being suppliers and breeders of seed ,farmers are also consumers of seed sold by corporations like Bayer and Monsanto. As breeders they have a right to recognition of their contribution .Theses are the rights recognized and upheld in the Plant Variety Protection and Farmers Rights act which was the implantation of the sui generis option in article 27.3 (b) of the TRIPS agreement .

As consumers they have a right to safe, affordable, reliable seed that has the qualities and traits which have been claimed by the seller , in this case Monsanto . Further , as consumers they have a right to compensation for harm done , for seed and trait failure ,and for false claims .

As the experience with Bt Cotton has shown, the dominant position of one player in the proposed combination has systematically violated farmer’s rights , both by displacing their varieties , creating monopoply and thus selling seeds at unaffordable prices, trapping farmers in debt. Debt trapped farmers are committing suicide. According to the Bureau of Crime records more than 300,000 Indian farmers have committed suicide, with most concentrated in the Bt Cotton Belt.

The farmers distress is already seen in the Bt cotton trade due to creation of a monopoly, rising prices, collection of illegal royalties, will spread in every crop if the combination is allowed, from staple foods to vegetables. Further the emerging of integration between seeds, chemicals and digital “big data” inputs will lock farmers into total dependence for inputs, raising costs of production, aggravating the crisis of debt and suicides, taking away farmers freedoms to use different seeds, methods of production, and freedom to trade in seeds and their products.

Monsanto’s exploitation has ruined farmers, trapped them in debt, driven them to suicide. After all, the hefty royalty is collected from small farmers ,even if is rooted through an Indian company as a licensee, just as the peasant paid the Lagaan, even when routed through Collectors and Zamindars . All of Monsanto’s violations of farmers rights are hidden by only presenting the licensing agreements as related only to industry , not the primary producer of food and final user of seed, the farmer

The Sublicense agreements clearly take away farmers rights to seed by restricting farmers to grow commodities , and not save seed.

As the sublicense agreement with Indian companies states

“Article 2.2 Sublicensing of farmers : The sale by sublicensee of Genetically Modified Hybrid Cotton Planting Seed to ant purchaser shall include a limited sublicense transferable to farmers to use such Genetically Modified Hybrid Cotton Planting Seed to produce a commercial crop within the territory “

This clause restricts farmers rights, and farmers trade , without their being party to the licensing agreement , and is unfair and anticompetitive for farmers . Their rights are restricted to growing a commodity , not saving seed ,without their knowledge . This is a serious impact on the freedom of farmers to trade .

Royalties collected by Monsanto from Indian farmers are therefore illegal . The extraction of royalties is criminal because it has taken farmers lives . Through the licensing agreements Monsanto established a monopoly in the cotton seed market. Monsanto controls 95% of the cotton seed supply through Bt Cotton . 85% of the more than 300,000 farmers suicides due to debt are concentrated in the cotton belt .

In less than two decades , cotton seed has been snatched from the hands of Indian farmers by Monsanto through displacing local varieties , imposing GMO Bt cotton seeds and collecting royalties.

We as farmers have been the breeders of seed from time immemorial. In the last 2 decades we have been made ‘buyers’ of GMO Bt cotton seeds. through manipulation of the seed, the seed market, and seed prices. Farmers have paid a high price for the high cost of Bt cotton seeds, with many ending their lives because of indebtedness – due to the high cost of seed and the pesticides necessary for Bt cotton. 95% of the cotton seed is Monsanto’s Bt cotton, sold under the trade name Bollgard (I and II). More than 80% of the 300,000 farmers suicides (since 1995) are concentrated in the cotton belt, and correlate closely with high cotton seed and pesticide costs, trapping farmers in debt.

The Government data (NCRB) clearly shows a difference in degree of stress faced in cotton growing regions like Maharashtra, Andhra Pradesh and Karnataka. In contrast, states like Haryana, Orissa and Bihar, which have high poverty rates among farmers, have suffered far fewer farmer suicides over the last 20 years.

In Maharashtra, suicide rates peaked from 2002 to 2006, during which period Monsanto was charging Rs 1600 per 450 gm packet of seed, of which ₹ 1200 was royalty.

Farmers deaths in Vidarbha have resulted from Monsanto collecting illegal royalty and trapping farmers in debt, pushing them to suicide, establishing monopoly, selling Bt Cotton with the false claim that it will control pests.

Monsanto knew that its actions were likely to cause farmers deaths. When the epidemic of farmers suicides started in the cotton belt where Monsanto had established its monopoly, Monsanto continued to extract illegal royalties and even initiated legal actions against the Agriculture Ministry and the Competition Commission when they tried to bring relief to farmers through their decisions. It thus deliberately aggravated the conditions leading to farmers deaths.

It is in this background that first the MRTP and now the Central Govt has ordered a lowering of seed prices, most of which used to be royalty to Monsanto, even though Monsanto did not have a patent on Bt cotton when it entered India illegally in 1998, and even when got commercial approval in 2002.

Every step of Monsanto’s presence in India is based on violations, including the Biosafety Laws that regulate entry of GMOs in India .

Monsanto introduced Bt cotton in India illegally in 1995.

GMOs are regulated in India by Indian Biosafety Law Rules for the Manufacture, Use, Import, Export and Storage of Hazardous Microorganisms, Genetically Engineered Organisms or Cells, 1989 — framed under the Environment (Protection) Act, 1986.

On 10thMarch 1995, MAHYCO, a collaborator with Monsanto, imported 100 grams of the Bt Cotton seed after obtaining permission from Review Committee of Genetic Manipulation (RCGM) under the Department of Biotechnology, and not from the GEAC, which, under the Environment (Protection) Act 1986, is the only body that can grant permission for importing genetically engineered substances (seeds in the present case). Monsanto MahyCo did not have the approval and that is why the import of 100gms of Bt Cotton seed in 1995 was illegal.

Rule 7(1) forbids imports without approval of GEAC.

(1) No person shall import, export, transport, manufacture, process, use or sell any hazardous microorganisms of genetically engineered organisms/substances or cells except with the approval of the Genetic Engineering Approval Committee.

In 1998 Monsanto- MAHYCO illegally began the large scale, multicentric, open field trials in 40 acres at 40 locations spread over nine states. These field trials were also started without the permission from GEAC even though it is the sole agency to grant permission for large-scale open field trials of GMO’s under the 1989 Rules.

According to Rule 4, only the GEAC has the power to grant approval for GMO imports and deliberate release into the environment for field trials and commercial release.

(4) Genetic Engineering Approval Committee (GEAC)

This committee shall function as a body under the Department of Environment, Forests and Wildlife for approval of activities involving large scale use of hazardous microorganisms and recombinants in research and industrial production from the environmental angle. The Committee shall also be responsible for approval of proposals relating to release of genetically engineered organisms and products into the environment including experiment field trials.

Rule 9 clearly forbids deliberate release without GEAC approval:

(1) Deliberate or unintentional release of genetically engineered organisms/hazardous microorganisms or cells, including deliberate release for the purpose of experiment shall not be allowed.

Note: Deliberate release shall mean any intentional transfer of genetically engineered organisms/hazardous microorganisms or cells into the environment or nature, irrespective of the way in which it is done.

Monsanto MAHYCO did not have the approval from GEAC for the field trials, therefore the trials of 1998 were illegal.

That is why I challenged Monsanto in the Supreme Court of India through my writ petition WPI 71 in 1999.

I filed a SPECIAL LEAVE PETITION (CIVIL) NO. 3762 OF 2004 to challenge the commercialisation of Monsanto Mahyco Bt Cotton, because the illegal planting of Bt Cotton of another company had been viewed as a threat to Biosafety and had been destroyed. It was also already known that GMO Bt Cotton fails to control pests. A case on the matter is still in the Supreme Court as CIVIL APPEAL NO. 4086 OF 2006

Selling a scientific fraud that Bt cotton is an effective pest control technology: a fraud that is costing farmers lives

The primary justification for the genetic engineering of Bt into crops is that this will reduce the use of insecticides. One of the Monsanto brochures had a picture of a few worms and stated, “You will see these in your cotton and that’s O.K. Don’t spray”. However, in Texas, Monsanto faced a law suit filed by 25 farmers over Bt Cotton planted on 18,000 acres which suffered cotton boll worm damage and on which farmers had to use pesticides in spite of corporate propaganda that genetic engineering meant an end to the pesticide era.

The sublicensing agreements also declare in 1 .17 (Rasi )

“Insect Tolerance” or “Insect tolerant” shall mean reduced damage from boll worms ( as well as from certain other insects of Lepidoptern which may be Sublicensed to fruiting parts of cotton plants which have been GeneticallyModified by recombinant DNA technology including but not limited to Bt.T genes “.

Thus not only were India farmers harmed as consumers because Monsanto created a monopoly in Bt Cotton Seeds , they were also faced with crop failure and damage because the Bt did not work in controlling pests .Monsanto was aware GMO Bt technologies are not sustainable as pest control technologies before it introduced Bt cotton to India .

http://journals.plos.org/plosone/article?id=10.1371/journal.pone.0029975

http://www.nature.com/nbt/journal/v31/n6/abs/nbt.2597.html?foxtrotcallback=true

https://ucanr.edu/repositoryfiles/ca5206p14-67769.pdf

https://in.reuters.com/article/india-cotton-idINKBN1AH2WJ

http://www.reuters.com/article/india-cotton-whitefly-idUSL3N12825L20151009

http://www.thehindubusinessline.com/blink/know/fly-in-the-face-of-bt-cotton/article8561303.ece

In 1996, 2 million acres in the US were planted with Monsanto’s Bt transgenic cotton called Bollgard, which had genes from the bacteria Bacillus thuringensis (Bt). The genetically engineered cotton generates a natural toxin to kill caterpillars such as cotton bollworm, tobacco budworm and pink bollworm.