What Is Bitcoin? Here’s What You Need to Know

ECONOMICS, 23 Apr 2018

Julian Goldie | King Passive – TRANSCEND Media Service

Cryptocurrency has taken the world by storm… but just what is Bitcoin? In this guide, you’ll discover everything you need to know about it.

What Is Bitcoin?

Launched in 2009, Bitcoin was the world’s first cryptocurrency…

Now, no-one really knows the true identity of it’s creator, Satoshi Nakamoto. In fact, that remains a mystery to this day!

But how does it work?

Well, Bitcoin actually uses advanced encryption techniques to secure and verify transactions. And unlike other currencies, Bitcoin and other cryptocurrencies can function without the need for any central authority…

This basically means it’s completely decentralized, thanks to blockchain technology.

- How Does Bitcoin Work?

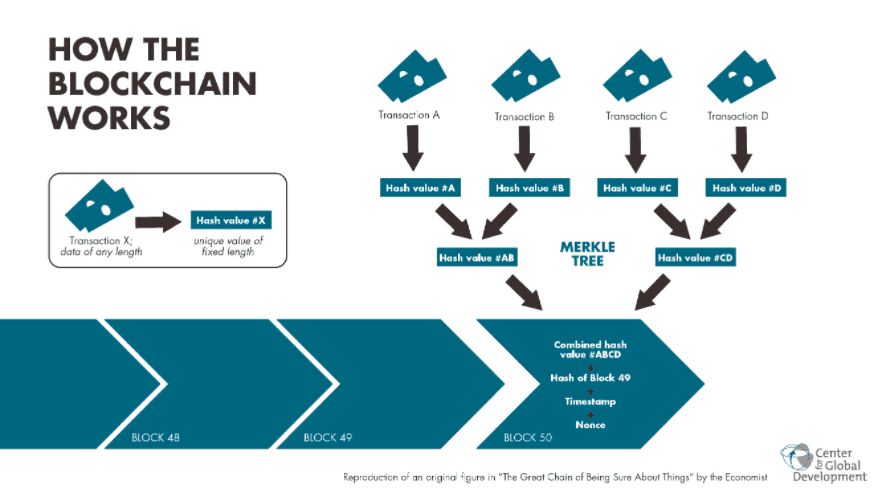

2.1. The Blockchain

To understand how Bitcoin works, you first need to understand the blockchain…

When you use traditional payment methods, such as credit cards, your transactions go through a bank.

The bank has to clear the transaction before it is verified and added to your account’s transaction history (account statement). Normally, this history is kept by your bank and only viewable by the bank and yourself.

The blockchain is a revolutionary technology because the transaction history paradigm we’ve been using for all these years is being flipped on its head.

Credit card transactions are stored in one location (with your bank) and usually viewable by only your bank and yourself. On the other hand, Bitcoin transactions are stored on nodes (computers or servers) across the world and viewable by the entire world!

With this new paradigm (the blockchain), transaction history is free from any foul play, such as changing records.

If you modify your copy of the blockchain (the record book of all Bitcoin transactions), everyone would know since your copy wouldn’t match the thousands of other copies of the blockchain.

To protect your privacy as well as that of others, users are identified by just two things:

- Wallet addresses (a string of random letters and numbers where people can send you Bitcoin). No one knows your address unless you give it to them

- Transaction amounts

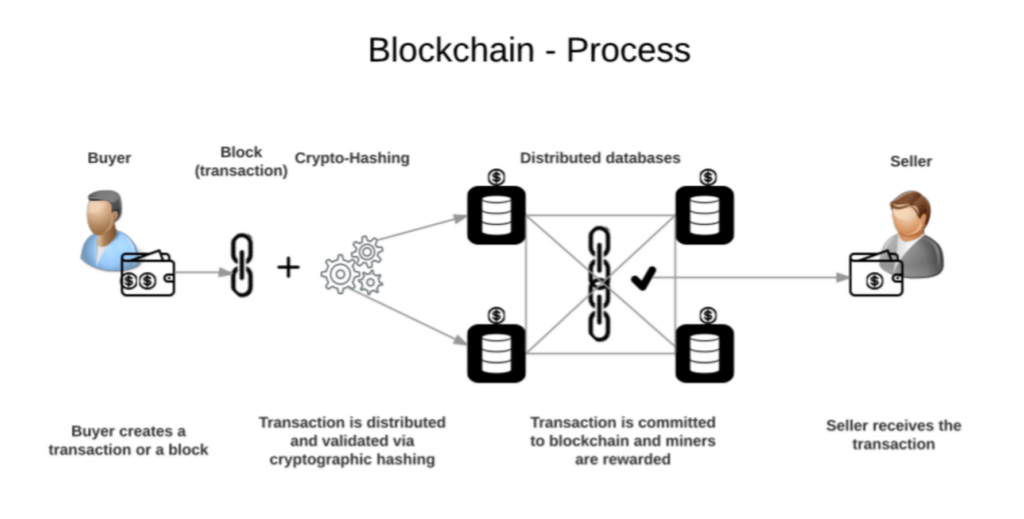

2.2. How Do Transactions Work?

So if there’s no central authority like a bank to process your transactions, how do Bitcoin transactions work?

As Bitcoin transactions happen throughout the course of a day, these transactions are grouped into what are called “blocks”.

These blocks are processed then added to the blockchain, or “chain of blocks” (the public ledger of all transactions).

While credit cards have payment processors like Visa to process transactions, Bitcoin has what are known as “miners”.

Since Bitcoin doesn’t physically exist, the name “miner” can be misleading.

Bitcoin miners are actually people or groups of people that run Bitcoin mining software on specialized Bitcoin mining devices known as application-specific integrated circuits (ASICs).

(Bitcoin mining used to be possible with personal computers but is now too resource-intensive).

When users of Bitcoin transact with the digital currency, their transactions are sent to the Bitcoin network, where miners pick them up and group them into blocks. These blocks are then added to the blockchain.

However, for each new Bitcoin block to be added to the blockchain, something called “proof-of-work” has to be performed to ensure that transactions are real and that the network remains secure.

Each new block has what’s called a “nonce” or a string of numbers, that, when found, allows for the block to be added to the block before it.

An easy way to think about this is comparing mining to finding the correctly shaped Lego piece (nonce) in order to attach it to the previous Lego piece (previous block in the blockchain).

Miners are the ones responsible for this “proof-of-work”, or finding nonces…

And thus confirming transactions and securing the Bitcoin network.

Proof-of-work mining is very resource-intensive in terms of computing power and energy. These days, finding the correct nonce is extremely difficult.

Most Bitcoin mining operations are now extremely professional and large in scale. Your everyday person simply doesn’t have the resources necessary to make Bitcoin mining profitable.

Miners have to invest in a ton of computing power (one or more ASICs) as the more computing power you have, the more times per second you’re able to try and guess the correct nonce.

(If you can guess more times per second than others, you have a higher chance of finding the nonce before them).

For their efforts, Bitcoin miners are rewarded with transaction fees, which users pay to miners to process their transactions quicker. They also get newly “minted” Bitcoins – if guess the right nonce and add a block to the blockchain.

Along with eliminating the need for centralized authorities like banks (vs. a network of miners), this proof-of-work mining system also makes it very difficult to modify the Bitcoin blockchain.

Modifying any one block requires modifying all blocks before it (since all blocks are tied to each other via nonces).

… Considering that as of April 2, 2018, there are over 500,000 blocks (each of which contains hundreds or thousands of transactions), the computing power necessary to change the blockchain makes such an attack infeasible.

Note: Even though the blockchain is secure, the storage of Bitcoin is still prone to hacks…

We’ll come on to that later.

2.4. Is Bitcoin Infinite?

As mentioned, every time that a block is added to the blockchain, Bitcoin is “minted” or created then released to the miner who found the block’s nonce.

However, this creation of Bitcoin is not endless, as when Bitcoin was created, the code was written so that the supply of Bitcoin would max out at 21 million.

This is significant and a huge factor that gives Bitcoin its immense value as fiat currencies, such as the United States dollar, are more or less printed at will. This leads to inflation and devaluation of currency.

In other words, every dollar or dollar-denominated asset you own, such as a house, decreases in value over time, as more and more dollars come into circulation. More dollars in existence means that each dollar is worth less due to dollars not being as scarce.

2.5. What Happens When Bitcoin Runs Out?

Many wonder what will happen when Bitcoin supply maxes out and no more Bitcoin are created. While no one can see into the future, there are a couple of predictions that have been thrown out there.

Of course, if no more Bitcoin is created, that means mining will cease to exist. As such, many think miners will be heavily affected since they will have no more incentive to mine and gain rewards from adding new blocks to the blockchain.

This may lead to miners backing out of Bitcoin mining, which may lead to centralization of Bitcoin as less people will store copies of the Bitcoin blockchain and confirm its validity.

Yet, others believe that miners will still be able to be part of the Bitcoin ecosystem as they will still be paid in transaction fees and ASICs may become more efficient in terms of energy usage (lower energy costs to run Bitcoin mining hardware).

Another prediction that people make is that if the supply of Bitcoin runs out, the price of Bitcoin will increase even further! Why?

People would scramble to get their hands on some of the remaining Bitcoin (assuming that Bitcoin continues to retain its value).

- How Is Bitcoin Stored?

3.1. Digital Exchange

Cryptocurrency exchanges like Coinbase and Kraken, where you can buy and sell Bitcoin, offer “wallets” on their websites where you can store Bitcoin.

3.2. Paper Wallet

Another option you have is a paper wallet, often thought of as the most secure Bitcoin storage method.

Paper wallets are piece of papers with your Bitcoin private key and public key.

Your private key can be used to access and send your funds from an online wallet. Your public key is your wallet “address” or where people can send you funds.

3.3. Hardware Wallet

Yet another popular storage option for Bitcoin is hardware wallets, such as the Ledger Nano S.

As with paper wallets, hardware wallets store your Bitcoin offline but this time in a device (the hardware wallet).

The hardware wallet is connected to your computer (usually via USB connection) when you want to make transactions.

Your private keys are kept on the device, which greatly reduces the risk of someone stealing your Bitcoin through online infiltration (such as an exchange getting hacked).

- The History of Bitcoin

Though Bitcoin is just over 9 years old, a lot has happened since its inception…

4.1. Satoshi Nakamoto

Founder(s) Satoshi Nakamoto first released a whitepaper detailing the vision for the cryptocurrency in November 2008. On January 3, 2009, Nakamoto mined the first Bitcoin block, thus starting the Bitcoin blockchain.

4.2. Forks

Nevertheless, this growth hasn’t come without its growing pains. Bitcoin has had splits (called forks) where Bitcoin has split into Bitcoin and other forms of Bitcoin, such as Bitcoin Cash and Bitcoin Gold.

These forks mostly came about due to community infighting over how to progress Bitcoin’s development.

The biggest development issue in recent times is how to address increased usage of Bitcoin as it grows more and more popular (otherwise known as improving Bitcoin’s “scalability”).

4.3. Lightning Network

Forks like Bitcoin Cash advocate scalability options like increasing blocksize.

For example, the current Bitcoin blocksize is 1 megabyte while Bitcoin Cash’s blocksize is 8 megabytes.

A larger blocksize means more transactions can fit in each block. In short, this means more transactions can be processed at once.

The original Bitcoin community (referred to as “core”) advocates other initiatives, such as the development of The Lightning Network.

This proposal advocates handling transactions between two parties off the blockchain (on the Lightning Network).

After transacting on the Lightning Network, the parties would send their ending balances to the original blockchain, greatly reducing the load on the original blockchain.

4.5. Bitcoin’s Evolution

However, Bitcoin eventually bounced back and in recent times, has seen tremendous growth in terms of factors, such as price and number of daily transactions.

4.6. The Rise of Altcoins

While Bitcoin remains the king of cryptocurrency for now, other cryptocurrencies (known as “altcoins” – short for alternative coins) have emerged.

Some altcoins like Ethereum and Litecoin are immensely popular themselves.

4.7. Mt Gox Hack

Over time, Bitcoin continued to gain in popularity, with services, such as the massive Mt. Gox Bitcoin exchange, arising as a result.

At its peak, Mt. Gox was responsible for 70% of all Bitcoin transactions. However, in February 2014, Mt. Gox closed its doors after it revealed that 850,000 Bitcoin had gone missing (valued at about $450 million at the time). This had an immensely negative impact on Bitcoin and cryptocurrency as a whole.

- The Benefits of Bitcoin

So why would anyone use Bitcoin over traditional currencies?

Though some would argue that Bitcoin’s high price isn’t justified, there’s no doubt that it has a list of benefits that give it value, such as scarcity, decentralization, anonymity, immutability, and divisibility.

Let’s run through them…

5.1. Scarcity

As mentioned, Bitcoin is scarce.

If people continue to see it as valuable in the future, its price will further increase similar to other scarce assets like gold as new Bitcoin creation continues to decrease.

5.2. Decentralization

Decentralization is another benefit of Bitcoin since thousands of copies of its blockchain are stored across the globe.

This means that no one malicious actor (or group of malicious actors) is able to manipulate Bitcoin without a near-impossible amount of computing power.

5.3. Anonymity

With the Internet and moving of transaction history online, anonymity has largely fallen by the wayside.

Nowadays, if you’re not using cash, banks and others can see how you spend your money, for better or worse.

Bitcoin restores some privacy back to the people by making transactions anonymous (aside from the addresses that Bitcoin is sent to and from as well as transaction amounts).

5.4. Immutability

As mentioned, Bitcoin transactions are immutable or can’t be changed since that would entail changing copies of the blockchain across the world.

This prevents problems with other digital currencies like double spending.

5.5. It’s Divisible

Also, while Bitcoin supply is fixed at 21 million, since Bitcoin doesn’t physically exist, it is infinitely divisible.

For example, you can have .1 Bitcoin, .01 Bitcoin, and so on and not just whole number amounts of Bitcoin. Thanks to its divisibility, Bitcoin is easier to obtain and move around than assets like gold.

- The Disadvantages of Bitcoin

- With the nature of a digital currencies, Bitcoin is vulnerable to hackers and malware. Security is a major threat to the industry.

- It’s hard to use for non-technical users when compared to payment methods like cash or credit

- Its value is very volatile and can even fluctuate significantly from minute to minute! Bitcoin’s volatility can make it impractical for everyday use

- Transactions are irreversible. If something goes wrong in a transaction and you don’t receive the product or service you paid for, you can’t get your money back

- Threats to the Future of Bitcoin

Although Bitcoin has gained a lot of public attention, its future outlook is unknown as there are both threats and opportunities facing it.

Here’s a few things to watch out for…

7.1. Government

For one, most governments are hostile towards Bitcoin and other cryptocurrencies, since they are a direct threat to the current financial establishment. Cryptocurrency regulations are becoming stricter as a result.

Governments are currently in charge of issuing currencies and controlling the flow of money.

If Bitcoin were to become widely accepted, governments would have much less importance in peoples’ lives.

7.2. Competitors

Furthermore, as mentioned, other cryptocurrencies have emerged.

As Bitcoin struggles to address scalability (transaction fees and times are becoming unbearable), other cryptocurrencies may swoop in and take Bitcoin’s place as the top cryptocurrency.

7.3. Hackers

Another threat is the threat of hacking. While Bitcoin has yet to suffer any hacks, it remains to be seen whether or not it can keep its perfect security record.

It’s not practical in the real world yet:

Lastly, another threat to Bitcoin’s future (and feasibility as an actual currency) is the fact that it isn’t practical for everyday users.

As mentioned, using Bitcoin is way too difficult for most people, which means that it won’t see everyday usage until changes are made.

- The Opportunities for Bitcoin

Regardless of these threats, many remain optimistic on Bitcoin’s future…

Bitcoin’s scarcity, decentralization, anonymity, immutability, and divisibility give it huge advantages over other payment methods and forms of currency, including altcoins.

- Scarcity makes Bitcoin more valuable than currencies like the dollar and euro, which are printed continuously and lose value as a result.

- Decentralization reduces the risk of fraud by any single party. It also spreads risk of failure across multiple servers (what if the Visa network were taken down?)

- Anonymity gives users more privacy in an age where user data is increasingly mined and sold to the highest bidder.

- Immutability protects merchants from fraud.

- Divisibility makes Bitcoin easy to procure and use.

While other cryptocurrencies have some or even all of Bitcoin’s beneficial properties, none have reached its level of popularity or security.

Even the #2 cryptocurrency, Ethereum, has suffered from security breaches, such as The DAO Hack, despite being younger than Bitcoin.

If developers can figure out a way to make Bitcoin easier to use and thus more accessible to the masses, it’s possible that Bitcoin could one day become as big of an invention as the Internet.

__________________________________________

Julian Goldie – I’ve created King Passive because I know there’s a lot of you out there who want to learn more about cryptocurrency – but maybe you don’t really know how to get started. You can find my latest crypto blogs and tutorials here.

Julian Goldie – I’ve created King Passive because I know there’s a lot of you out there who want to learn more about cryptocurrency – but maybe you don’t really know how to get started. You can find my latest crypto blogs and tutorials here.

Go to Original – kingpassive.com

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.