| Prognosis: The pandemic and the pace of oil demand recovery from the coronavirus crisis are posing a significant challenge for oil producers in rebalancing the market, according to the IEA. Oil-producing countries and oil companies now have to factor in many more variables in their plans, including economic forecasts and various speeds at which vaccines are being used in different countries. “Producers are grappling with massive uncertainty about where this goes from here. So high is the uncertainty that the OPEC+ group decided in December—just when Europe was renewing lockdowns to fight soaring coronavirus cases—to hold monthly ministerial meetings to decide production policies.

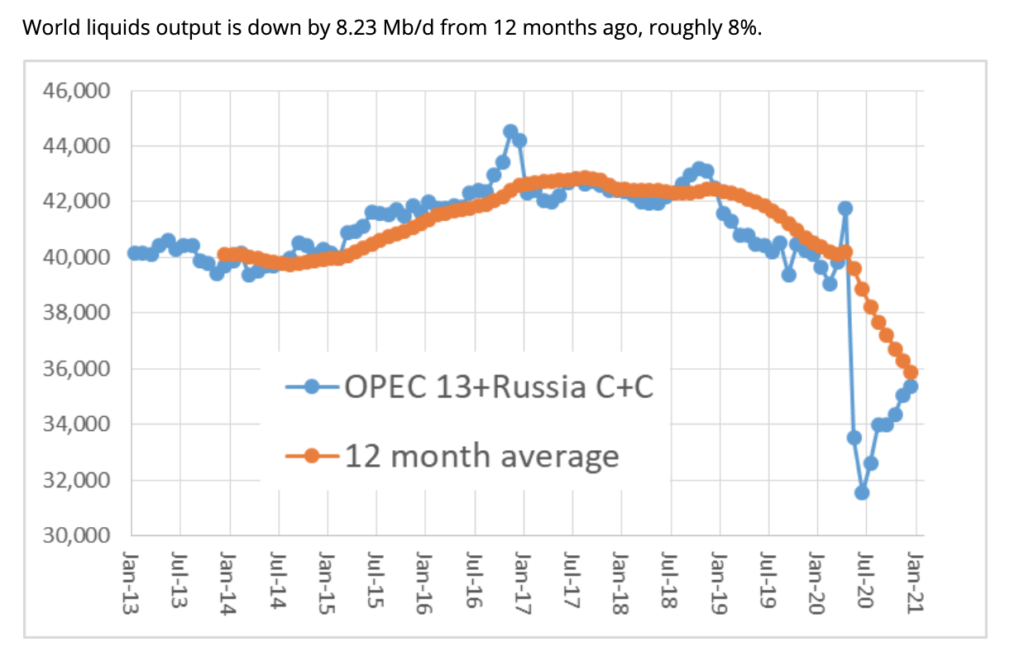

While the December decision of the OPEC+ alliance was to boost production in January by 500,000 b/d, thus easing the cuts from 7.7 million b/d to 7.2 million, the January meeting refrained from lifting output in February too much, except for a compromise boost to Russia’s production by 65,000 b/d. Saudi Arabia went the extra mile and pledged unilaterally to cut its crude oil production by an additional 1 million b/d. Analysts view the surprise cut as a sign that the Kingdom expects weak oil demand in the first quarter of this year.

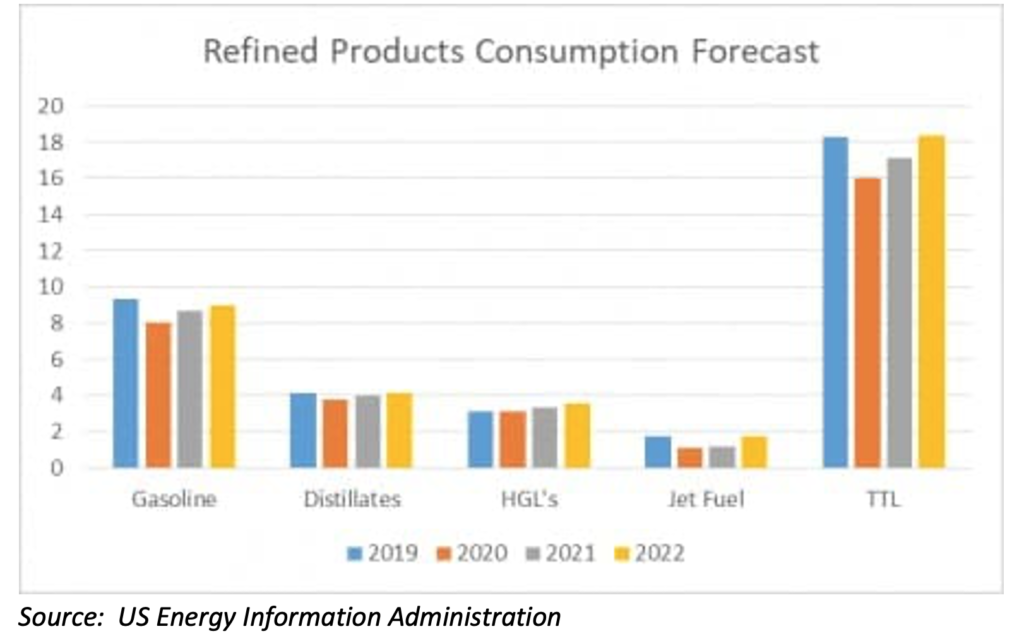

A growing number of experts and international agencies warn that the world could be headed for an oil shortage when oil demand finally recovers from the pandemic in late 2022 or 2023. Last year, the pandemic slashed global oil demand, which is not expected to return to pre-crisis levels for at least another year and a half.

However, the coronavirus also accelerated a structural decline in upstream oil investments as all E&P firms, oil supermajors, US shale producers, and national oil companies alike slashed capital expenditures in the wake of the price crash. Investments in new oil supply have now slumped to a more-than-a-decade low. If the industry doesn’t raise upstream investments in coming years, the oil market could be headed to a supply crunch after oil global demand recovers, analysts and forecasters warn.

Countries dependent on oil revenues for much of their budgets will become increasingly vulnerable to problems caused by the global energy transition, according to the head of the IEA, Fatih Birol. The world will still need oil this year and next, and for years to come, but it will need less and less of it, Birol said.

Birol’s comments came after the IEA reported it would release the first comprehensive roadmap to net zero emissions. The roadmap, according to the report, “will set out in detail what is needed from governments, companies, investors, and citizens to fully decarbonize the energy sector and put emissions on a path in line with a temperature rise of 1.5 degrees Celsius.”

2. Geopolitical instability

(These are the situations that reduce the world’s energy supplies or have the potential to do so.)

Iran: According to the governor of the Central Bank, oil revenues have halved since the US imposed sanctions on the Islamic Republic in 2018. The country’s oil revenues have dropped from more than $40 billion in 2018 to less than $20 billion in 2019 and 2020. As early as 2019, Iran’s Oil Minister Zanganeh admitted that Iran’s oil industry had been dealt a “deadly blow” by the US sanctions. Last week, Iran said that the US must pay Tehran as much as $70 billion in reparations for the damage the sanctions have caused.

For nearly three years, Tehran has been waiting for President Trump to leave office and to try its hand at negotiating against a perceived weaker Democratic opponent. In anticipation of the US administration’s change, they have been rolling out more bargaining chips, including stepped-up nuclear enrichment, demands for reparations, and taking hostages in hopes they can negotiate to have the sanctions lifted and still retain their missile development programs. The most serious of these moves is work on an assembly line to manufacture a key material used at the core of nuclear warheads and restarting production of fuel for its Tehran Research Reactor, a facility that runs on uranium enriched to higher levels.

The National Iranian Oil Co. signed eight more oil projects as part of a $6.2 billion program started in January 2019 to boost oil production by 355,000 b/d.

Iraq: Baghdad announced a deal with Lebanon that could gradually move Lebanon deeper into Tehran’s sphere of influence. Tehran sees Lebanon as a critical player in the Shia crescent of power that it has been meticulously developing for years. Under the deal, Iraq will begin exporting fuel to Lebanon this month. Given that Iraq itself suffered from serious power shortages over the summer, this is a major sacrifice by Baghdad that will likely result in Iran gaining more influence in the region.

After a record-setting 2019, annual oil output fell by about 760,000 b/d last year as Iraq made extraordinary cuts to help support global prices. In December, nationwide crude production fell slightly to about 3.86 million b/d, capping a year of OPEC-related constraints that yielded the lowest output since 2015. Fields managed by the federal government produced about 3.46 million b/d in December — a decrease of 2 percent compared to November — while those under the authority of the Kurdistan Regional Government rose slightly to 477,000 b/d.

3. Climate change

President-elect Biden is setting up a bigger White House climate team than any president before him. The president-elect announced the planned hiring of more than a half-dozen new climate staffers to join his West Wing. The crew is drawn from the ranks of green groups, environmental justice advocates, and former Democratic administration officials to grow an inner circle that will help him try to slash the nation’s greenhouse gas emissions.

That team will be tasked with executing a wide-reaching plan to embed climate action across government agencies and in legislation on Capitol Hill. Biden has also pledged to address the disproportionate pollution burden carried by poor and minority neighborhoods. Biden’s incoming climate team is a mix of new faces and old hands. Biden also plans to add one of the architects of Obama’s plan for cutting emissions from the power sector to the Environmental Protection Agency, a sign of environmental regulation to come.

Placing a dollar value on the contribution of climate change to storm damage has been tricky. Now, Stanford University researchers have determined that a third of the financial damage caused by flooding in the US over the past three decades—almost $75 billion worth—can be attributed to excess precipitation caused by climate change. Their paper, published in the journal Proceedings of the National Academy of Sciences, is the first to make such a comprehensive estimate.

Under the EU’s massive economic recovery program, more than 500 billion euros will start flowing to help the region clean up its energy, industry, transport, and farming sectors. The “Green Deal,” a central pillar of the recovery plan, will be turned into legislation, making irreversible Europe’s ambitious target to become the world’s first climate-neutral continent by 2050. Included in these changes will be new climate laws, tighter rules on the carbon market, higher charges for carbon emissions, and cleaner cars.

4. The global economy and the coronavirus

The World Health Organization’s chief scientist warned that even as numerous countries start rolling out vaccination programs to stop COVID-19, herd immunity is highly unlikely this year. While the recorded death count from the Covid-19 pandemic is now over 2 million, the true extent is far worse. More than 2.8 million people have lost their lives due to the pandemic, according to a Wall Street Journal analysis of data from 59 countries and jurisdictions. Deaths in these places last year surged more than 12 percent above average levels.

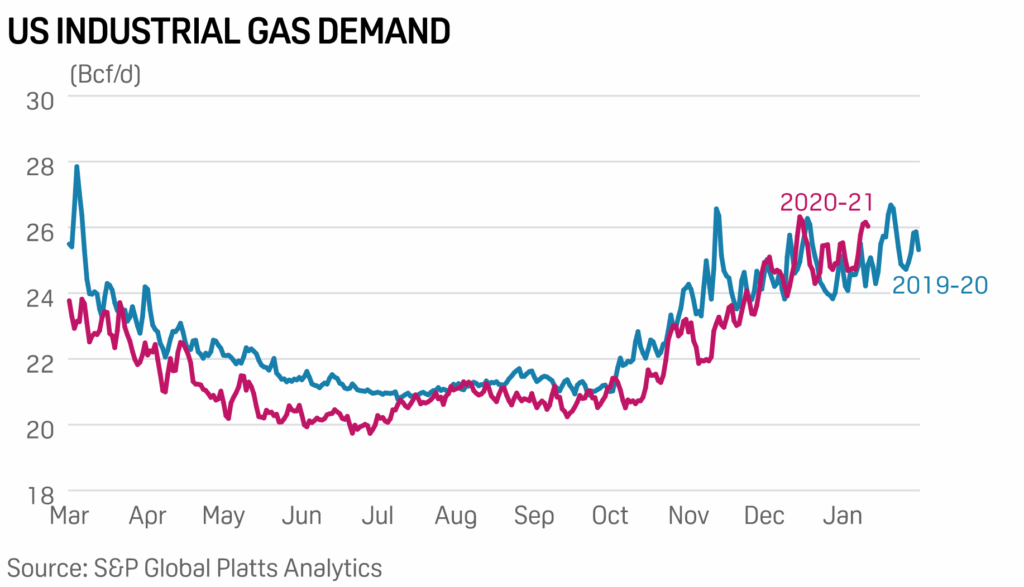

The economic distress of the pandemic is picking up where it left off at the end of 2020. The latest data show activity in the advanced economies softened in the first two weeks of the new year. In the US, government figures showed retail sales fell for a third month in December as a resurgent virus prompted another tightening of business restrictions. Europe is facing the possibility that output will shrink in consecutive quarters.

United States: The number of people seeking unemployment aid soared last week to 965,000, the most since late August and a sign that the resurgent virus has increased layoffs. The latest figures for jobless claims remain at levels never seen until the virus struck. Before the pandemic, weekly applications typically numbered around 225,000. They spiked to nearly 7 million last spring after nationwide shutdowns took effect.

Federal health officials sounded the alarm Friday about a fast-spreading, far more contagious variant of the coronavirus projected to become the dominant source of infection in the country by March. The Centers for Disease Control and Prevention said that its forecasts indicated outbreaks caused by the new variant could lead to a burgeoning pandemic this winter.

As the US goes through the most lethal phase of the coronavirus outbreak yet, governors and local officials in hard-hit parts of the country show little willingness to impose any new restrictions on businesses to stop the spread. And unlike in 2020, when the debate over lockdowns often split along party lines, both Democratic and Republican leaders signify their opposition to forced closings and other measures. Some have expressed fear of compounding the heavy economic damage inflicted by the outbreak. Some see little patience among their constituents for more restrictions ten months into the crisis. And some seem to be focused more on the rollout of the vaccines that could eventually defeat the threat.

President-elect Biden proposed a $1.9 trillion rescue package to combat the economic downturn and the Covid-19 crisis. This package outlines the type of total aid that Democrats have demanded for months and signals a shift in the federal government’s pandemic response. The package includes more than $400 billion to combat the pandemic directly, including money to accelerate vaccine deployment and to reopen most schools within 100 days safely. Another $350 billion would help state and local governments bridge budget shortfalls. Simultaneously, the plan would also include $1,400 direct payments to individuals, more generous unemployment benefits, federally mandated paid leave for workers, and large subsidies for childcare costs.

China: Beijing has imposed its most widespread restrictions since the start of the coronavirus pandemic, placing travel restrictions on about 23 million people and putting some areas into lockdown after a sudden rise in cases. Since last July, China’s total reported symptomatic cases had exceeded 100 on Wednesday, the most significant outbreak. Ninety of the new infections were in Hebei province, next to Beijing.

China ended the year in many ways stronger than it started. While the US and Europe wait for vaccine rollouts to get more people vaccinated, China became the only major economy expected to report growth for 2020, helping it close the US’s GDP gap. It has expanded its role in global trade and shored up its position as the world’s factory floor, despite years of US efforts to persuade companies to invest elsewhere. China’s consumer market—lifted by its quick recovery from Covid-19—keeps gaining momentum, making it a bigger driver of global companies’ earnings. And the country has solidified its standing as a force in global financial markets.

China’s economy is expected to have grown 6.1 percent in October-December from a year earlier, after the third quarter’s 4.9 percent expansion. The economy has been recovering steadily from a steep 6.8 percent slump in the first three months of 2020 when the outbreak of COVID-19 in Wuhan’s central city caused widespread lockdowns.

Chinese exports grew more than expected in December as coronavirus disruptions fueled worldwide demand for Chinese goods. A robust domestic recovery also spurred the Chinese appetite for foreign products in December, with import growth quickening from the month prior and beating expectations.

China’s crude imports fell to a 27-month low of 9.09 million b/d in December, but total imports over 2020 were up 7 percent year on year at 10.86 million b/d. The last time monthly imports were lower was in September 2018 at 9.092 million b/d.

Europe: Road traffic in most of the continent is at its weakest since the end of the first lockdowns in the late spring of last year as more people stay at home with renewed lockdowns. Despite the start of vaccinations in Europe, many countries continue to battle record daily new coronavirus cases and have been on lockdown, again, since before Christmas.

According to Rystad Energy, road fuel consumption across Europe has significantly dropped due to the lockdowns in recent weeks. Still, overall oil demand in Europe is not as low as it was last spring because the frigid winter in most parts of the continent drives up the use of oil products for heating. Nevertheless, the lockdowns are sapping oil demand again, and consumption is unlikely to pick up materially over the next two to three months.

The UK is under stay-at-home orders nationwide at least until the middle of February, with people not allowed to leave their local area and allowed to go out of their homes only for essential shopping, which cannot be done from home, and once-a-day outdoor exercise. Germany, the biggest economy in Europe, is also on nationwide lockdown until at least January 31st, while the Netherlands will be locked down until at least February 9th.

Russia: Rosneft is in talks with some of the world’s largest oil trading houses, offering them the opportunity to become investors in a major oil project in Russia’s far north. The Vostok oil mega project is in Siberia and has resources estimated at 44 billion barrels. These oil fields are close to the Northern Sea Route that Rosneft plans to use to ship oil to Europe and Asia.

Saudi Arabia: Aramco is lining up a $7.5 billion deal for potential investors in its oil pipelines. The discussions are occurring in parallel with the sale of a stake in a pipeline unit, which could raise about $10 billion for Aramco, sources said. A pipeline deal would be the first phase of Aramco’s strategy to raise money by selling leasing rights or stakes in non-core assets.

5. Renewables and new technologies

More hydrogen facilities and bigger storage batteries for electricity generated by wind towers and solar panels were announced last week. Siemens is developing a commercial offshore wind turbine that produces hydrogen via electrolysis. The company is investing $146 million in the system, which would be the renewable industry’s most concrete plan to capitalize on an expected boom in hydrogen demand.

Some of Asia’s biggest potential hydrogen consumers are hopeful that Australia will achieve its aim of sharply reducing production costs to supply green hydrogen at $2/kg in the future. Hydrogen costs below $2/kg are not unusual for conventional hydrogen produced from natural gas. However, even with carbon capture and lower gas prices, a polymer electrolyte membrane or PEM electrolyzer operating at 70 percent capacity would need input power prices to be average below $15/MWh to produce hydrogen for less than $2/kg.

Another big battery project has been announced in Australia, as energy storage developers rush to profit from the nation’s abundant sunshine and wind resources. Origin Energy wants to install a 700-megawatt facility near the Eraring coal plant in New South Wales. That comes as utilities worldwide run to install warehouse-sized batteries to back up wind and solar generation. The current record holder, a 300-megawatt facility, opened in California last month.

Occidental Petroleum plans to build a facility which the company says could change the way the world thinks about fossil-fuel emissions. The globe’s first large-scale direct air capture (DAC) plant would remove carbon dioxide from the atmosphere and pump it underground.

The goal is to lower emissions of the primary greenhouse gas responsible for global warming—and one day even produce a carbon-negative barrel of oil. But to cover the cost of operating the plant, Occidental will initially use much of the CO2 to push out oil from underground reservoirs, thereby replacing one pollutant with another. The facility, expected to cost hundreds of millions of dollars, will also need support from tax credits and outside investors to be financially viable. |