BRICS Is Being Battered by Global Crises: Why This Might Not Be a Bad Thing

BRICS, 4 Sep 2017

Patrick Bond – The Conversation

30 Aug 2017 – That was the theory, but the economic reality of the once-feted Brazil-Russia-India-China-South Africa alliance is contradictory.

Instead of centripetal strengthening, the world is witnessing much more powerful centrifugal dividing forces, including overproduction, over-indebtedness and deglobalisation of capital. These elements have been spinning out of control even before the chaotic era of US President Donald Trump began.

Over production is mostly found in the coal, steel, non-ferrous metals, cement and chemicals industries. It’s largely driven from China where over-capacity is more than 30%, according to a new International Monetary Fund report that also raised worries about the country’s vast debt.

Over borrowing by companies, states and households represents a global crisis in the making. The Institute of International Finance has just reported that world debt is now USD$217 trillion (327% of world GDP), up from USD$149 billion (276%) in 2007.

Deglobalisation is simply the reversal – mostly since 2008 – of prior rapid growth in cross-border trade, investment and finance. Should that be viewed as a bad thing? Rather than fear globalisation’s unravelling, leading scholar-activists including Samir Amin in Africa, the late Ruy Mauro Marini in Latin America, Walden Bello in Asia and the 20th century’s most important economist, John Maynard Keynes, have all advocated national economic sovereignty. If pursued cleverly, deglobalisation could be the basis for restoring links between once vibrant sectors subsequently destroyed by imports.

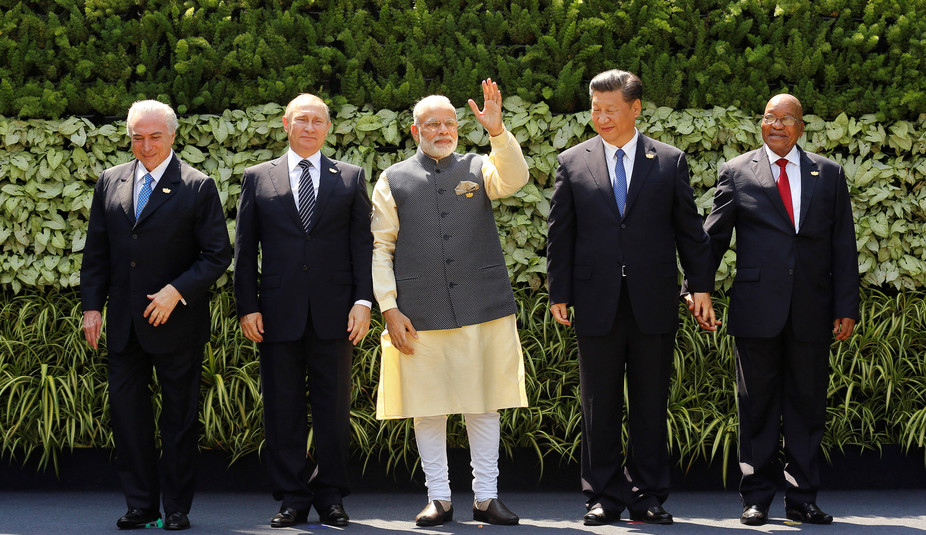

Could BRICS leaders evolve in this direction? Their summit next week will be distracted by geopolitical tensions. Although a welcome deal on Monday prevents the feared Sino-Indian border war, a much more durable geo-economic battle is unfolding in the China-Pakistan Economic Corridor, which in May left Prime Minister Narendra Modi boycotting China’s Belt and Road mega-conference three months ago.

Beijing’s BRICS logo designers, perhaps being unconsciously subversive, have illustrated how the once overlapping, interlocking BRICS are now being wedged apart as paper thin subjects of centrifugal forces. For Africa, fewer illusions in these economies would be welcome, given how exploitative the BRICS and their firms have become against societies, democratic movements and environments.

A counter-summit challenges the BRICS

This argument is made by the Hong Kong People’s Forum, initiated by the city’s progressive labour, intellectual and faith leaders to question the BRICS. Their meeting this weekend follows in the counter summit traditions of the 2013 brics-from-below in Durban, the 2014 Dialogue on Development in Fortaleza, and the 2016 Goa People’s Forum on BRICS.

According to the Hong Kong People’s Forum:

Instead of offering an alternative, the BRICS actually offer a continuation of neo-liberalism. On top of BRICS there is also China’s new mega project, the Belt and Road initiative whose main purpose is to export China’s surplus capital.

These surpluses are vast, as witnessed in China’s foreign reserves which recently topped USD$4 trillion, though then fell 20% due to bouts of capital flight and two stock market crashes in 2015-16.

Deglobalisation

Global trade, finance and investment were meant to be the motors for the advancement of BRICS. But according to the World Bank, global trade peaked at 61% of world gross domestic product (GDP) in 2008 but retreated to 58% in 2015.

During the 1990s each BRICS country raised its trade to GDP ratio by at least 10 points. But trade has receded in importance in each of the BRICS. Russia peaked first at a 69% trade/GDP ratio in 1999, and then fell steadily to 45% today. Brazil rose to 30% in 2004 and fell to 25%. China soared to 66% in 2006 and has since plummeted to 36%. South Africa’s 2008 ratio was 73% but is now back to 60% and India peaked last, in 2012 with 56%, and is now at 40%.

On top of this, the ratio of world financial assets that are held overseas compared to GDP fell from 58% in 2008 to 38% in 2016, even as overall financial assets increased in line with soaring debt.

Finally, another deglobalisation symptom is the halving of relative global foreign direct investment: from 3.7% of world GDP in 2008 to 1.7% in 2016.

Leading financiers now talk of an imminent world recession, given over priced stock markets and corporate debt. This is not just due to wild New York share speculation, as also occurred before the crashes of 1987, 2000 and 2008. Three BRICS stock markets are also bubbling: South Africa’s stock market is 90% higher than in 2010, India’s market is up 70% and Russia has risen by 50%.

Centrifugal realities crowd out centripetal fantasies

These dangerous centrifugal forces cannot be easily regulated or reversed. The only recent relief came from the Chinese state’s massive urban construction investments (albeit leaving scores of near-empty cities) and the Indian service sector boom. But since 2015 the other three BRICS have suffered recessions as the crash in commodity prices hit home.

As the Hong Kong People’s Forum statement explained:

China has now evolved into a global engine promoting a neo-liberal agenda from free trade agreements to corporate led integration across borders.

The BRICS had promised to challenge an unfair global economic system. But in December 2015 their main multilateral reform strategies failed:

- the Paris Climate Accord was non-binding, unambitious and outlaws climate-debt lawsuits by victims of Western and BRICS emissions;

- the World Trade Organisation phased out any semblance of food sovereignty; and

- IMF voting shares were shifted to favour BRICS at the expense of poorer countries.

Adds the Hong Kong People’s Forum: “The 2017 World Economic Forum in Davos was one site where Xi clearly took the lead in promoting world corporate power, as Trump leads the US-UK retreat into crony-capitalist protectionism.”

South African President Jacob Zuma pronounced last month at his party’s policy congress, “The ANC is part of the global anti-imperialist movement. We are historically connected with the countries of the South and therefore South-South cooperation such as BRICS is primary for our movement.”

If centrifugal economic forces now pressuring the bloc overwhelm Xi’s desired centripetal capitalism, then we can expect yet more talk-left walk-right politics, as the BRICS sub-imperialists desperately try to pretend they’re anti-imperialists.

___________________________________________

Patrick Bond – Professor of Political Economy, University of the Witwatersrand

Patrick Bond – Professor of Political Economy, University of the Witwatersrand

Republish The Conversation articles for free, online or in print, under Creative Commons license.

Go to Original – theconversation.com

DISCLAIMER: The statements, views and opinions expressed in pieces republished here are solely those of the authors and do not necessarily represent those of TMS. In accordance with title 17 U.S.C. section 107, this material is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. TMS has no affiliation whatsoever with the originator of this article nor is TMS endorsed or sponsored by the originator. “GO TO ORIGINAL” links are provided as a convenience to our readers and allow for verification of authenticity. However, as originating pages are often updated by their originating host sites, the versions posted may not match the versions our readers view when clicking the “GO TO ORIGINAL” links. This site contains copyrighted material the use of which has not always been specifically authorized by the copyright owner. We are making such material available in our efforts to advance understanding of environmental, political, human rights, economic, democracy, scientific, and social justice issues, etc. We believe this constitutes a ‘fair use’ of any such copyrighted material as provided for in section 107 of the US Copyright Law. In accordance with Title 17 U.S.C. Section 107, the material on this site is distributed without profit to those who have expressed a prior interest in receiving the included information for research and educational purposes. For more information go to: http://www.law.cornell.edu/uscode/17/107.shtml. If you wish to use copyrighted material from this site for purposes of your own that go beyond ‘fair use’, you must obtain permission from the copyright owner.